bitcoin trillion dollar market cap

On January 20, 2017, Grayscale Investments LLC filed for an initial public offering ( IPO ) for its Bitcoin Investment Trust to be listed on the NYSE Accra exchange in an attempt to bring bitcoin investing to the masses through a publicly tradable investment vehicle in the form of a new stock.Grayscale Investments , the investment management subsidiary of the Barry Silbert-led Digital Currency Group, established the Bitcoin Investment Trust ( BIT ) in 2013, hoping to provide investors with the opportunity to invest in the digital currency bitcoin without having to purchase and securely store the digital currency themselves.The Bitcoin Investment Trust , which carries the ticker GBTC, tracks the TradeBlock XBX Index 24-hour VWAP bitcoin index and charges a 2 percent annual management fee.The Trust currently has around $262 million assets under management.Shares in the Bitcoin Investment Trust can be traded over-the-counter and can be held in traditional investment accounts, such as IRAs and Roth IRAs.

By going public, Grayscale Investments wants to open up its bitcoin investment vehicle to a broader investor base that prefers the comfort of investing in an exchange-traded and fully regulated security.On May 4, 2017, Grayscale Investments LLC submitted an amendment to its IPO filing with the SEC increasing the size of its proposed IPO from $500 million to $1 billion dollars suggesting that the interest in a publicly-tradeable and regulated investment vehicle that tracks the price of bitcoin would see substantial interest from institutional and private investors.However, given the SEC recent decisions not to approve the long-awaited Winklevoss Bitcoin ETF ( COIN ) as well as the SolidX Bitcoin Trust, the chances for the Bitcoin Investment Trust's IPO to gain regulatory approval are not high.While Alan Friedland, founder and CEO of Compcoin, doesn't hold much hope for the ETF approval just yet, he agrees that there is enough demand from established institution investors for bitcoin as an alternative asset class to merit the $1 billion IPO increase.

"Digital coins will be the fastest growing financial market and we are projecting a 1.7 trillion dollar market cap by 2025," he told Bitcoin Magazine .When the SEC announced in March that it would not approve the two proposed bitcoin exchange-traded funds, the regulator stated that a bitcoin ETF would require "surveillance-sharing agreements with significant markets for trading the underlying commodity or derivatives on that commodity.

litecoin step by stepAnd second, those markets must be regulated."

ethereum stack exchangeSince these conditions are still not met for bitcoin, an approval of the Bitcoin Investment Trust looks rather unlikely.

sovereign bitcoin exchangeSpencer Bogart, analyst at Blockchain Capital , thinks that it is "highly unlikely" that this renewed ETF consideration will be approved.

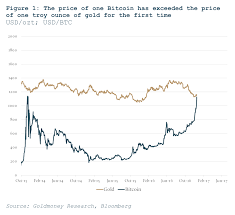

"The SEC disapproved the prior two ETFs not because they took issue with the structure of the fund but because the SEC currently considers the major markets on which bitcoin is traded to be too unregulated," Bogart told Bitcoin Magazine ."Given that this hasn't changed since the last disapproval, the SEC is unlikely to offer a different response."Bogart is more optimistic about the chances of an ETF approval outside of the United States."I think mainstream investment products will first be approved by foreign regulatory agencies (to some extent this has already happened).In regards to the approval of a U.S.-listed Bitcoin ETF, I think it's more likely that the SEC changes its view (e.g.with regime change) than it is that the Bitcoin ecosystem changes such that the majority of activity flows to highly regulated markets."Bitcoin as a peer-to-peer electronic cash system cannot be allowed to survive.The destablizing effects of this currency on capital markets threatens to be enormous.At the time of writing, one bitcoin is already worth over $2000, and it just keeps growing.

What’s worse is that it’s clear, from observations of the currency over the last 8 years, this growth in value is exponential in character.To those of us that understand the effects of this growth, it’s clear that Bitcoin will become impossible to stop in just a few short years unless something is done about it right now.What’s fascinating is that most individuals will usually reject the reality of this impact even if they are presented with the hard numbers showing its effects.This curious reality accounts for the fact that we can use a relatively small interest rate to get others to pay for a loan twice or three times over if we are able and prepared to wait, and will be able to use the capital return to multiply itself again by simply selling more loans.A modicum of initial capital, patience, and a firm trust in the exponential effect is really the key to it all.Broken down by year, the average value and average growth per day looks like this:2009: $0.00/0.00%2010: $0.06/+0.88%2011: $6.54/+1.23%2012: $8.47/+0.34%2013: $188.79/+1.43%2014: $525.33/-0.17%2015: $271.83/+0.16%2016: $588.76/+0.25%2017 (to date): $1211/+0.650%If we calculate the average daily change in the value of bitcoin since its inception in 2009 up to the present, it has been a staggering +0.52126%.Without making any further assumptions, the million dollar bitcoin will arrive on or around August 13, 2020.Given current evidence, the end-of-year value of bitcoin for this year, and going forward a further 5 years will be:2017: $6,906.602018: $46,068.412019: $307,285.772020: $2,060,343.082021: $13,742,910.712022: $91,668,031.51It also shows that in 5 years time, if nothing is done, then we can expect Bitcoin to be more important than any other payment mechanism on the planet; By end of 2022 there will be over 19 million bitcoin in the money supply, with a potential market capitalization approaching 200 trillion dollars.Even if we were to reject the evidence before us and assume that bitcoin is currently overbought, and that it cannot maintain the historical level of growth, this conservatism is only delaying the inevitable for a few short years:Estimate value $2,000, expect growth 0.4%, $1M bitcoin: Aug 30, 2021Estimate value $1,500, expect growth 0.3%, $1M bitcoin: Jun 5, 2023Estimate value $1,000, expect growth 0.2%, $1M bitcoin: Nov 13, 2026What can be done to avoid this catastrophe?

We obviously need to retain the ability to benefit from their holdings by the traditional method of exercising capital advantage.After all, it’s important that control of capital remains in the correct hands.Well, the first thing to do is to constrain throughput.If you can’t transact, then bitcoin can’t possibly work as a currency at all.Fortunately, this is easy to achieve as the current software enforces a trivial 3-4 TPS throughput and has maxed out the network at levels way below those necessary for continued growth.This is greatly assisted by the inability, or unwillingness, of any of the system actors to remove this limit.The Bitcoin community appears to be in an interminable deadlock, so this constraint could by itself, be sufficient to achieve our aims.Fortunately, there appears to be support for a solution called “Segregated Witness” that would ensure that the network throughput will continue to grow slowly and stay below 10TPS for quite some years to come.However, all this may not be a sufficient or fully reliable way to stop the Bitcoin system.Another related approach, and one that would be recommended in addition to throughput constraints, would further ensure the desired outcome.

This would be to kill general adoption.This is easily achieved by leveraging these throughput limits to price out the lower end of the market by using fee schedules.Ideally, these fees would be sufficiently high to eliminate low value transactions, but be beneficial to those of us that wish to move large capital volumes.Fortunately, in Bitcoin, fees are calculated by the transaction data size and not by the value being transferred.This, of course, plays perfectly with the requirement that capital leverage becomes the key factor and is able to destroy any remaining “currency” aspect of this system.There is also a great opportunity here, if we are able to use the above strategies to effectively commoditize the token in this system as a traditional asset.We merely need to build a more traditional financial second layer on top of the commodity.There’s already a foundation with a proposal called the “Lightning Network”.This has great acceptance in the community, but crucially requires that the value is backed by assets on the Bitcoin network.