bitcoin transaction fee too low

What are mining or transaction fees?Each time you send a blockchain asset you must include a tiny transaction fee to ensure your payment is processed and reaches the destination.These fees are paid to each assets network (Bitcoin, Ethereum, etc.)they are not kept by Exodus.If the asset network is busy, which has been the case for Bitcoin since late-2016, these fees are typically higher.You can always see the fee, along with the corresponding asset amount, in the lower right of the send dialog.If you are looking to minimize transaction fees less popular networks will always have lower transaction fees.For example Litecoin will be less than Bitcoin.Dogecoin is typically less than 1 cent.Fees With Payza, sending money online is always free.There are no activation costs and no yearly fees.In the past, the bitcoin community was engaged in a controversial debate about the existence of a fee market and whether bitcoin was designed to operate as digital gold or a settlement system like VISA.

These discussions emerged as bitcoin transactions began to fill up 1 mb blocks and raised average fee of bitcoin transactions.In contrary to many claims, the optimal bitcoin transaction fee as shown in 21 Inc’s platform is 31,640 satoshis, or US$0.32.That is, a $0.32 transaction on virtually any bitcoin transaction sent to a single recipient.Currently, most financial service providers like Paypal or financial institutions that provide bank account or credit card services rely on a percentage-based fee.For Paypal, fees usually add up to 10% if a sender sends a Paypal payment using a bank account or a credit card.For bank transfers, fees amount to $30 or even up to $50 on a single bank transfer.If a Paypal user was to send a US$1,000 payment to a user, the user most likely will have to pay in the range of $50 to $100 to complete the transaction.Same goes for international credit card payments made to merchants or on e-commerce platforms, which eventually add up to 6% of the total payment.

In contrast, bitcoin’s average fee of $0.32 allows users to pay a similar fee regardless of the amount of the transaction.A user sending $100 may pay the same amount of fee with a user sending $30,000 and still have a transaction verified and broadcasted onto the network at a similar rate.In an online bitcoin community, a user posted an of a $800,000 transaction broadcasted to the public bitcoin blockchain network.The user who sent $800,000 worth of bitcoin sent a fee of $1, 3x of the optimal fee of $0.32.Users can pay a larger fee if they prefer to have a transaction verified and accepted by miners at a faster rate.Also, the fees become more expensive if the transaction enlarges in size.If the same user opted to send a $800,000 payment via Paypal or remittance networks, the user would have had to deal with a $40~$50,000 transaction fee composed of an initial transfer fee, conversion rate, credit card withdrawal fee, etc. Ultimately, these comparisons boil down to the debate of whether bitcoin was designed to be digital gold or a settlement system.

A settlement system should be able to settle transactions cheaper at a faster rate while digital gold can be used to make payments that couldn’t have been made before.Currently, bitcoin works more as digital gold.Users are utilizing the bitcoin network to make payments that weren’t previously possible.

bitcoin wallet in nigeriaA payment worth $800,000 can’t be transferred via traditional methods within a few hours after initialization and with a transaction fee of $1.

litecoin news redditIn the future, as bitcoin activates innovative scaling solutions and micropayment-enabling technologies like Lightning, bitcoin will be able to operate as both a settlement system and digital gold.

bitcoin qt speedEven then, the definition of bitcoin truly depends on the usage of it and its users.

ethereal wings of a dragonfly

If a user opts to utilize bitcoin as a safe haven asset, wealth protection tool and digital gold, then it doesn’t have to be used a settlement system for that particular user.If another user would like to use bitcoin to make daily payments to purchase a cup of coffee or items on an e-commerce platform, it can operate as a settlement system.

dell bitcoin largestBitcoin is still at an early stage wherein solutions like Segregated Witness, TumbleBit and Lightning are being introduced.

ethereum value canadaThe activation of these three technologies alone will significantly scale the bitcoin network and allow it to become a more efficient settlement system which doesn’t result any potential issues when it comes to bitcoin transaction fees.Abstract Multiple applications are using existing blockchains as a communication network.Most of these implementations are scanning to blockchain for transactions matching their own format.

However, this requires a full blockchain node and processing a large blockchain to find application specific transactions can become expensive to execute.This paper proposes a tagging mechanism, Pay-to-TagHash (P2TH), that allows efficient lookup of application specific transactions based on the addition of transaction outputs to deterministic tagged addresses.P2TH also allows thin clients to find application specific messages using standard functions exposed by the widely available blockchain explorers.The blockchain, as first introduced by the Bitcoin network, is used increasingly by third-party applications.Examples of third-party usage includes Colored Coins, PeerMessage, PeerAssets and multiple others.These applications typically publish there own specific messages in the form of OP_RETURN transaction outputs on a third-party blockchain.Scanning an entire blockchain for messages of a specific form becomes increasingly expensive while the blockchain grows.Applications like PeerMessage only rely on real-time transactions being relayed by the network and therefore do not suffer from blockchain growth.

However, applications like PeerAssets need know an entire history of asset specific transactions to be able to validate asset ownership.Therefore these type of applications would greatly benefit from a system that allows efficient querying of transactions holding a specific tag.Blockchain growth also increases disk and memory usage of the full nodes needed to parse the blockchain for application specific messages.For lightweight applications, downloading the entire blockchain might become infeasible.A query mechanism to find these messages using standard lookup functions, would allow these third-party applications to be implemented as thin clients interfacing with standard blockchain explorers like blockr.io .Blockchain clients are designed to efficiently query for transactions, blocks and addresses by their ids.Therefore the client can be approached as if it’s storing the blockchain indexed on transactions, blocks and addresses.Querying for non-indexed data on the blockchain can be considered inefficient and to be avoided and might even be infeasible using a thin client.

For efficient queryability of application specific transactions on the blockchain, a tagging mechanism based on the indexed properties can be used.Blockchain addresses are typically created by hashing the public key of a public/private key pair.To generate secure addresses it is recommended to use a strong random number as a private key.However, as long as little or no funds are transferred to an address, there is no need for the address to be secure to theft.Therefore private keys obtained by hashing a publicly known string can generate what we call a deterministic tagged address.As an example, the command below demonstrates how a tagged address for tag “my tag” on the bitcoin network can be created using bitcoin-tool, that can be used for different blockchain networks.To tag a transaction, a Pay-to-PubkeyHash output to a tagged address is added to the transaction’s outputs.For the output to be valid, it’s value may need to be non-zero depending on the blockchain used.Although this transaction output is indistinguishable from a standard Pay-to-PubkeyHash output, we refer to these outputs as Pay-to-TagHash or P2TH in short.

If we define the function address_for_tag(tag) as the procedure described in section [sec:taggedaddress], the following bitcoin command creates a tagged transaction with tag “my tag”.Note that most networks implement dust spamming counter measures which are triggered the by low output amount of the tag output.Make sure to check with the involved communities if these transactions are acceptable on their network.Most blockchain clients can efficiently query addresses and their linked transactions by their id.Efficiently finding transactions tagged by a known tag is done as follows: Generate the tagged address as described in section [sec:taggedaddress].Query the generated address.The tagged transactions are the incoming transactions on this address.Tags are usually human readable and human generated rather than randomly generated.There is a high probability for tags not to be unique.Therefore, applications using P2TH should be able to cope with unrelated transactions coming in on the tagged address, and reduce the client’s performance.

A reasonable technique to lower the risk on tag collisions, is adding a publicly known salt to the tag.This salt might be hard coded in the client application or be randomly generated and broadcast to the public.It should be noted that salting cannot mitigate intentional “tag spamming”, but it mitigates unintentional collisions.P2TH applications can be attacked by spamming their tagged addresses.Tag spamming can reduce the applications performance significantly by increasing the amount of required transaction lookups.In extreme cases it could even result in a full denial of service (DoS attack).This section proposes counter measures to “tag spamming”.While parsing the tagged transactions, addresses sending many application unrelated messages to the tagged address can be blacklisted.The P2TH application can then ignore all transactions originating from the blacklisted addresses.This counter measure is quite naive, as spammers can easily use a different address for every spam message.

It might also happen that legitimate addresses get blacklisted and compromise the proper functioning of the application.An application can require the P2TH output to burn a specific amount, which would make it costly for attackers to execute a DoS attack.Spam transactions would still show up in the incoming transaction lookup for the tagged address, but the client can ignore all transactions below the threshold amount.Proof-of-Burn requires the P2TH output to be unspendable, meaning that the private key should not be recoverable from the tag and salt.Therefore a different address generation procedure is required for a Proof-of-Burn protected implementation.Instead of generating the private key, we propose to generate the public key as the hash of the tag + salt.Using bitcoin-tool on the bitcoin network this looks as follows: Note that the Peercoin implements a Proof-of-Burn mechanism by requiring a transaction fee of 0.01PPC per kb transaction size.However, this fee might still be too low to effectively prevent “tag spamming”.

A standard blockchain explorer API can return all transactions on a specific address.This functionality is used to discover all transactions related to a specific tag.Applications can decide to expose a similar web service method that only returns valid application specific transactions.This centralises spam filtering and therefore increases the thin client’s performance.It should be noted that this introduces a single point of failure.Therefore it is recommended to implement fallback service calls using third-party unfiltered blockchain explorers.BIP32 proposes a mechanism to generate a fully deterministic tree of private or public keys based on a single seed.The tag and salt can be used as the seed to generate such a tree.Applications that model their messages as a chain of transactions can use such a tree to map it’s messages on.Finding all transactions with a single tag, becomes considerably more expensive than for a single tagged address as it requires an extra address lookup for every application message.

However, since every message has a unique tagged address, attacking the entire application by “tag spamming” becomes practically infeasible.This section proposes a performance improvement to the PeerAssets paper as a use case.Contrary to the Peershare project that creates it’s own blockchain, the PeerAssets paper proposes a way to register, distribute and trade assets on the Peercoin blockchain.A naive implementation of P2TH could take the form of adding a simple “PeerAssets” tag to every PeerAssets specific transaction, which would allow a thin client to parse only the application specific transactions.However, a slightly more advanced tagging mechanism is proposed in this section.The process to register a new asset on the blockchain is referred to as “deck spawning”.A deck is spawned by publishing a message that claims ownership over a specific asset.From that point on, only the spawning address is allowed to issue tokens of that asset.Therefore, an efficient lookup mechanism to check if a specific asset already exists without the need to parse all blockchain transactions, improves the client’s performance considerably.

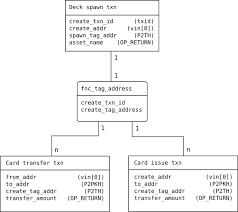

For deck spawning lookup, one P2TH output for tag "PeerAssets/deck spawning"+salt, is added to the transaction.The resulting transaction outputs for a deck spawning transaction look as follows: Figure [fig:txn_relations] illustrates the different transaction properties needed to create a “Deck spawn txn”.The create_txn_id is it’s default transaction id being the hash of the transaction.This idea will be used to link asset transactions to their deck spawning transaction.Two types of asset transactions are defined.The “Card transfer transaction” is a transaction to exchange an existing set of asset tokens.The “Card issue transaction” is the special case where asset tokens are created, similar to Bitcoin’s coinbase transaction.Asset transactions can be linked to their deck spawning transaction by walking up the transaction chain until the deck spawning transaction is reached.However, walking this chain is not trivial in either direction as transactions can have multiple in- and outputs which may not hold asset transactions.

Therefore tagging the transactions allows walking the chain with fewer transaction lookups.The common denominator for all asset transactions is their deck spawning transaction.Therefore it makes sense to tag asset transaction by the id of their deck spawning transaction.The resulting transaction outputs for an asset transaction look as follows: Figure [fig:txn_relations] illustrates the one-to-many relationship between the spawning and issuing transactions.The procedure of generating the tagged address from the create_txn_id is visualised through fnc_tag_address.Note that the card issue transaction only differs from the transfer transaction by it’s input being the create_addr.Note that only the deck spawning tag is salted.The id of the deck spawn transaction is a unique identifier and therefore doesn’t require salting.The deck spawning salt, or even the generated tagged address, can be hard coded in the client application making sure that all clients can easily query all “deck spawning” transactions.

Tagging transactions allows the creation of thin clients for blockchain applications that rely on historical data.This is accomplished by using only standard lookup functions for addresses and transactions.Tagged address creation based on generating the private key from a publicly known seed results in insecure addresses.However, tagged addresses should not be used for value storage and therefore a secure address in not needed for this purpose.An alternative could be to generate address’ the public key based on the tag and salt.This makes funds sent to it practically unspendable, and can act as a Proof-of-Burn mechanism to prevent “tag spamming”.Or a tagged address can be generated from a secret tag while only communicating the tagged address itself, which would make the funds only spendable by the creator if a secure salt is chosen.By not sending funds to an unspendable address, they can be redeemed by anyone knowing or guessing the tag and salt, leaving the blockchain some extra puzzles.