bitcoin shared coin

In my previous post I addressed the hype surrounding blockchain — mostly in a context of the application of blockchain technology to the financial industry.Now it is time to think about the hype surrounding coin (or token) — which hype is constantly manifested as endless ICOs, speculation and forks.This post covers such questions:Most people believe that a coin is absolutely necessary in a blockchain and that in turn motivates them to invest money in an ICO.When situation is either black or white — one has to take sides.at the same time you read in press:The terms of this debate are somewhat misleading.And here is why:The first problem lies in a common understanding what is blockchain as a technology.I know that many people describe blockchain differently.But if you ask “why” enough times, at the end of your inquiry you will find agreement regarding the key features of blockchain.And it happens that blockchain is not about currency, but rather about consensus over some digital asset.

Which assets need a blockchain are described here.Or in other words, what people mean when they use the word cryptocurrency?Reason #1 is pretty clear and unfortunately very often read as “ let’s earn money right now using the hype”.Reason #2 is ok, but then it is not a coin, but rather a share (with all of the legal consequences of being a security).Reason #3 is ok too, and since you can account for anything, even tomatoes in a warehouse, to name it a coin is a little bit strange.Reasons #4–7 are more complicated.

bitcoin linux walletMy guess is that the founders want to create an economy.

bitcoin marketplace scriptAnd an economy needs control.

bitcoin bg forumWhy do we have national currencies?

typical litecoin mining rate

To control the economy — prices, inflation, subsidization of particular industries, control of competition, etc. If there are no monetary politics then a currency is not needed.But, many blockchain projects introduce a currency, but don’t introduce the economic rules which will make that economy successful.So, if you are willing to create a coin or evaluate one, the first question would be whether the new economy will be sustainable.

bitcoin ncrThe second question — which projects should have a coin — is very important.

bitcoin litecoin ukThis is because the wrong answer might quickly disappoint the community, investors and other key stakeholders.To answer this question we need to differentiate amongst various blockchains somehow.

bitcoin hfThe model and reasoning behind this process was introduced in the previous post.

bitcoin arrest in florida

Here is the result.I truly believe that only systems from the top-left quadrant could have a coin because of reasons #4–7.Examples are Bitcoin, Monero etc. I say “could” because Bitmessage provided a very good example of a proof of work system with anonymous nodes which don’t need a coin or even a shared blockchain.Any proof of stake blockchain does not need a coin.

gems bitcoin socialRather, what is needed is an ideal payment method (or currency) which is recognized by everybody.This universally acknowledged payment method would allow for the handling of security deposits by the miner (security of proof of stake mainly relies on confiscating a stake in case of misbehavior).I am not saying that such ideal currency exists, but I think we are very close.I will describe the criteria for such an ideal currency in the next post.FBA blockchains (Ripple, Stellar) don’t need a coin at all.In this scenario coin neither increases stability nor effectively defeats spam.

Validators are not paid with the fees in any case.They can use any existing coin (bitcoin, ether, etc.)to execute settlements with the highest efficiency.Private blockchains don’t need a coin by default.Although they can operate based upon a digital asset (representing fiat), or some synthetic currency (e.g., SDRs issued by the IMF).But, until this blockchain becomes the primary source of information about fiat accounts, they must always be backed by something.In general, if the system don’t manage scarce asset it doesn’t need blockchain at all.The best architecture for such a system is an open network — examples are Tor, Torrent, Bitmessage, DHT etc.I think that Ethereum as a smart contract platfrom could exist without a native coin (unless you define Ethereum as programmable money).The same applies to Storj, Waves, List, Maidsafe, Ripple, Factom, Filecoin and many others.It seems strange for consumers to buy another currency in order to pay for storage.Why not to use Bitcoin instead?There are few strong rationales for creating a native coin in a blockchain.

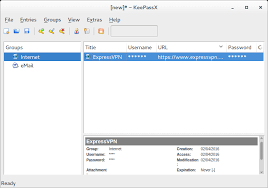

The most important one is the creation of a new economy.But… let’s think for a moment before participating in ICO — could the same technology solve the same problems without the coin?To jump to Part 1 of this step by step guide to buying Bitcoins to pay for VPN anonymously, please click here.So far in this series we have looked at how to buy Bitcoins as anonymously as possible, and we now have Bitcoins that should in no way be connected with us personally (and we have further obfuscated our trail by moving them from one wallet to another).This next step is therefore entirely optional, simply increasing the anonymity of your Bitcoins.We are, of course, going to use our Bitcoins for perfectly legal purposes, so this stage may be considered overkill, but we do feel that Bitcoins should be mixed on principle, as for them to work as an anonymous currency, maximum obfuscation is desirable.A Bitcoin mixer, also known as a Bitcoin laundry or Bitcoin tumbler, is a service that breaks the link between you and your Bitcoins, mixing your funds with others so the trail back to you is confused.

Depending on the exact method used, while Bitcoin mixing may not guarantee 100 percent anonymity in the face of a highly determined and powerful adversary (such as the NSA), it does provide a very high level of anonymity, and it would be a very arduous task for anybody (including the NSA) to link you with properly mixed coins.There are a number of well known mixing services, with Blockchain.info’s ‘Send Shared‘service being by far the largest and most well known, although Bitcoin Laundry and The Bitcoin Laundry are also popular.These services are easy to use and are highly effective, but fact that they have been used shows up clearly in a coins’ blockchain.In addition to this, because these services are well known, they are almost certainly being monitored, and possibly backdoored by the likes of the NSA or GHCQ.Mixing coins more than once, especially using different mixing services, will go a long towards addressing these problems, but if you are truly paranoid they should be avoided altogether.

The flipside however, is that the larger a mixer service (i.e.the more users it has to exchange Bitcoins with), the more effective it is.In general though, using lesser known mixer services will almost certainly improve anonymity, but there is no guarantee they will not simply run away with your money. to arrange an in-person meetup, where you exchange coins face-to-face, or simply opening a wallet with a large Bitcoin company not particularly known for Bitcoin mixing (i.e.not Blockchain.info), or for its draconian identity check and Bitcoin analysis practices (i.e.Gox), moving your money there, and letting it rest for a couple of hours before transferring it to another wallet.An important point to remember with this last method is to take out less than you put it in, so metadata analysis will not be able to correlate to the amount withdrawn and amount deposited to follow your tracks.For the purposes of this guide we will simply use Blockchain.info’s Send Shared service.It is easy to use, highly anonymous (with the provisos outlined above), we are pretty sure Blockchain.info won’t simply disappear with our money, and at the end of the day we are buying a VPN subscription, not drugs, guns or a hit man.

Shared Send matches up your coins with another user.When a match is found, your coins are swapped, thus breaking the transaction chain from your wallet, and coins are swapped multiple times to make the chain even harder to follow.As a US company it is almost certain that Blockhain.info is being monitored, but since your wallet cannot be traced back to you as an individual, and nor can most of those you are swapping coins with, a very high level of anonymity will still be achieved.We created a new wallet using the Android app Bitcoin Wallet.Then simply go to the Send Shared webpage, and enter the address you want to send your mixed Bitcoins to (in our case the Bitcoin Wallet address we just created).A temporary Bitcoin address is created for you to send your coins to.Once mixed, these will then forwarded to address provided above.Note that there is a minimum transaction amount of 0.2 BTC, and a maximum of 250 BTC. to buy some more 4.So in our Blockchain.info wallet we send the money to temporary address specified.

We’ll just send all our Bitcoins, but if you want avoid potential metadata analysis correlation then you should break up your transactions into smaller, randomly determined amounts 5.And about 2 minutes later the mixed money (minus the transaction fee) turns up in our Bitcoin Wallet!Blockchain.info allows to you verify how well mixed coins are with its Taint Analysis Tool.Note that this can be used to analyse any Bitcoin, not just those mixed using Send Shared.On the main Blockchain.info page enter the destination address into the search box 2.Click on ‘Taint Analysis’.You can now analyse the ‘taint’ i.e.the relationship between the input (sending) address and the destination address.For the first few transactions the taint remains high… …but by the end of the transaction chain the taint should have completely gone At no point should you see the input address (you can check by using your browser’s page search function).If you send the coins to a Blockchain.info wallet then additional tools (such as a Chord diagram for a visual display of the results) are available, but we are happy with the extra anonymity afforded by moving our funds away from Blockchain.info.