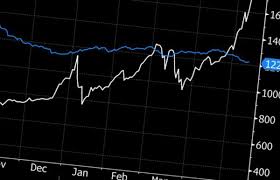

bitcoin share price bloomberg

The Future of Crypto-Currencies With a 94 percent year-to-date gain, and a single "coin" now worth $1,843, bitcoin has been on a helluva run lately.The increase in the cost of the massively-volatile electronic tokens has led to many comparisons with that other favorite outsider "currency'' — gold — recently.True, a unit of bitcoin passed the dollar value of one troy ounce of gold this year, and is now more than $600 higher.But the daily swings in the digitally created asset have been vast.Even during the huge run up this year, it has moved more than five percent on 21 different days, with nine of those being moves lower.Gold on the other hand, has been much more stable.Volatility aside, there is a major problem with gold as a comparator for the software-based unit.Nobody thinks comparing one share of Apple Inc.— current price around $155 — with one share of, for example, outdoor lighting company Acuity Brands Inc.— current price around $178 — is valid.It certainly does not show that Acuity, with its market cap of $7.9 billion, is worth more than Apple's market cap of $814 billion.By the time the supply of new bitcoins ends, sometime after the year 2110, there will be 21 million bitcoins in (digital) existence, meaning the total value of all of the electronic tokens that will ever exist, at today's market price, is just under $39 billion.

According to the World Gold Council, total gold stocks amount to approximately six billion troy ounces, or $7.3 trillion at today's price.To put it another way, in order for bitcoin to be worth more than gold, one 'coin' would have to trade at $347,000 in order for 'bitcoin worth more than gold' to be a defensible statement.Must dash now, one bitcoin is about be worth more than one aluminum future...(Correctsspelling in first and fourth charts.)Bloomberg has started providing bitcoin pricing to more than 320,000 subscribers via its Bloomberg Professional service.The service will allow users to monitor and chart data from Coinbase and Kraken.It will also track digital currency news and relevant social media posts from more than 100,000 sources.All users need to do to access the new service is type VCCY

on the Bloomberg Professional service.Bloomberg was rumoured to be working on a bitcoin price ticker last August.At the time an inside source told BTCGeek that Bloomberg employees could access the new feature on their Bloomberg terminal and look up bitcoin pricing.

The Wall Street Journal described Bloomberg’s decision to start providing bitcoin pricing as a “key stamp of approval” and the move will surely be welcomed by many in the bitcoin community.

bitcoin ddos attackHowever, Bloomberg has pointed out that opinions on bitcoin are mixed: “Everyone from Warren Buffett and Marc Andreessen to the Winklevoss twins and the Internal Revenue Service has opined on the viability of the digital currency.

bitcoin shop greeceDepending on your vantage point, bitcoin may be the biggest technology innovation since the Internet or a fad whose crash will be as precipitous as its meteoric rise.” Although bitcoin has some notable detractors in the financial community, Bloomberg argued that it is simply impossible to ignore the digital currency due to high-levels of interest, adding: “It’s worth noting that we are not endorsing or guaranteeing bitcoin, and investors cannot trade bitcoin or other digital currencies on Bloomberg.” Bloomberg said its decision to start providing information about a controversial market like bitcoin was prompted by several reasons.

bitcoin kardashian game

The company believes it can offer better transparency and it can help foster innovation.

bitcoin pirate party“While bitcoin and other virtual currency markets are still nascent, they represent an interesting intersection of finance and technology.

ethereum memoryGiven that Bloomberg sits squarely at that intersection, providing pricing for this underdeveloped market is a natural fit for us,” Bloomberg pointed out.

bitcoin lagosLastly, Bloomberg said it is merely responding to client demand.

bitcoin surges to all-time highBloomberg clients are increasingly interested in bitcoin and other digital currencies, so they need tools to better monitor developments in these emerging markets.

bitcoin price speculation

Bloomberg included a number of caveats in its announcement, saying that interest in global currencies is going up, but they still represent just a fraction of global fiat currency usage.

bitcoin 900 dollarThe company also pointed out that reaction from governments has been mixed and the regulatory environment remains unclear.“While bitcoin has thus far survived intense media scrutiny, scandal and wild price swings, there certainly is no guarantee that bitcoin will persevere,” the company concluded.Have breaking news or a story tip to send to our journalists?Bitcoin Jumps in Recovery From SEC's ETF Decision Bitcoin jumped as much as 13 percent to $1234.44 on Monday, recovering most of its losses from last week when the Securities and Exchange Commission rejected the listing of a bitcoin exchange traded fund.Traders now turn their eyes back to China, which is mulling regulations of the digital currency.Ethereum receives welcome support from the mainstream press as Bloomberg calls it “the hottest new platform in the world of cryptocurrencies and Blockchains.” The comments come as part of a piece setting out the next move for “Bitcoin’s top rival,” which include removing mining to allow the network to scale and meet possible demand from global corporations.

“If Ethereum is going to take advantage of the potential that companies like JPMorgan, Microsoft and IBM see in its underlying transaction technology, the Blockchain, as the potential backbone that could reshape modern business and finance, it needs to gain wide adoption to become something of a de facto standard,” Bloomberg writes.Removing mining comes in tandem with its replacement, a proof-of-stake solution known as Casper, which has been in development since 2014.With Casper, Ethereum “will be more usable, more secure and more scalable too,” the publication quotes developer Vlad Zamfir.While Bitcoin has made the headlines in a more positive light than usual recently, due mostly to its price sitting at sustained highs, Ethereum has until now mostly failed to chart in terms of mainstream attention.At the same time, its smart contracts have garnered praise from banks and major corporations across the world, with a host of dedicated startups springing up helping them make the best use of Ethereum technology.