bitcoin price raw data

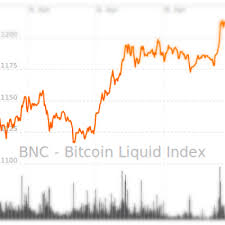

Bitcoin has been trading between ~$1075-1200 this week, according to the BLX, on heavy bullish momentum.Total Network Hashrate continues to make all-time highs, despite the ongoing scaling debate.The Network Hashrate is set for a 4.51% rise on about April 12th, increasing 51.89% year to date.Over the past week, evidence has come forth suggesting why bitcoin mining chip manufacturer Bitmain continues to oppose Bitcoin Improvement Proposal (BIP) 141, Segregated Witness (SegWit).The covert use of AsicBoost provides a 20% competitive advantage towards mining blocks, and is incompatible with SegWit.There is evidence of it’s existence in current chipsets, but no clear evidence it was used, as the covert form may be completely undetectable.The news preceded is a split in support for Bitcoin Core and Bitcoin Unlimited (BU) this week.Currently, SegWit and BU support is roughly even, but support for SegWit is expected to grow at a steady pace.SegWit’s testnet mined a 3.7MB block last week, which is almost 4x the current block size ceiling.Meanwhile, Japanese exchange volume continues to dominate the global market, led by BitFlyer, which currently trades almost as much volume as all of the USD exchanges combined.The Ichimoku Cloud is a constant, auto-drawn indicator which quickly offers a trade an immense amount of valuable information on any timeframe.

The cloud is best used at higher timeframes as more data generally provides truer signals and less false positives.The indicator uses moving averages and dynamic support and resistance to make projections of key zones, as well as capturing 80% of any given trend.As long as the price remains above the cloud, sentiment remains bullish.Price in the cloud indicates a neutral trend, and below the cloud indicates a bearish trend.When the Tenkan (T) is over the Kijun (K) sentiment is bullish.K over T would indicate bearish sentiment.When the Lagging Span (LS) is above the cloud and above the price sentiment is bullish, below the cloud and price would indicate bearish sentiment.The best entry signals for the cloud occur when trend is obvious, but 1 or 2 of the signals have yet to become confluent with a higher timeframe trend.On the daily timeframe, mixed messages continue for the cloud signals.Price is above cloud but the TK cross remains bearish.A strong long entry signal would be the TK cross above cloud, with bids on kijun.

A similar setup occurred on February 7th.The strong pullback two days later coincided with unfavorable regulatory news out of China.Another way to measure a longstanding trend is with a pitchfork.There are a few versions of the pitchfork, beginning in 2015, depending on the exchange your viewing.Be sure to use the log scale and pick an extreme low with a swing high and low.The median line (red) gives the expected mean of the trend.

bitcoin gtx 1060Price will continually attempt to return to this diagonal.

bitcoin private key algorithmEach diagonal of the Pitchfork can be thought of as a potential reversal zone or support/resistance line.

bitcoin data center swedenThe upper blue diagonal zone being ‘most overbought’ or the top bounds of the trend and lower blue diagonal zone being ‘most oversold’ or the bottom bounds of the trend.The trend continues with no threat of stopping anytime soon, with price reaching for a return to mean.

gh/s bitcoin miner

Should this trend continue to year’s end, an expected price of $1800 is reasonable, based on the lower bounds of the pitchfork.The four hour Heikin-Ashi (HA) candlesticks can be used to assess the strength of an active trend.Heikin-Ashi candlesticks manipulate the raw open and close data from the previous period to better smooth the trend.Stops may be continually moved up based on the bearish candles in a bull trend, a long-wicked candle, or a doji, which would signify a drop in momentum.

bitcoin graph inrEntry usually occurs when at least two candles match the active trend following a pullback or stop out.Depending on how stops are used, each of these trend flip and continuation trades may or may not have been stopped out on each leg up and pullback.

litecoin in plnTwo HA candles are currently green again, but are showing little to no momentum.

bitcoin inventor photo

Until momentum returns, HA is not showing a strong long entry signal, which would likely have limited upside to the local top of the overarching move down.In the meantime, the previous bullish butterfly harmonic has played out exactly as expected ,with price currently sitting at A-C diagonal resistance.There is also another bearish harmonic, at the current level, which has formed off the bullish butterfly.

bitcoin miner software open sourceConsidered an advanced harmonic pattern, the shark is a bearish harmonic with a target of ~$1000-1050.

bitcoin grafica valorA stop would typically be placed above the 1.272 fibonacci retracement from point C to D, with a short accumulation zone between point D and the 1.272 fibonacci retracement.Evidence for creating an unfair mining competitive advantage has caused BU support to plummet.All long signals on the Ichimoku cloud have yet to flip bullish, but the longstanding pitchfork shows no threat to trend.

HA candles are showing a slowing of bullish momentum at the diagonal resistance of A to C on the completed bullish butterfly harmonic.An advanced bearish harmonic has formed forecasting a target between $1000-1050 in the coming days, should the 1.272 fibonacci extension from points C to D hold as resistance.Recent Posts Using Stata to count a sequence Using Stata to count segments Datastream Navigator update 4.6 Thomson content update February 2017 Thomson Eikon & Event windows Archives April 2017 March 2017 February 2017 December 2016 October 2016 August 2016 July 2016 June 2016 May 2016 April 2016 March 2016 February 2016 January 2016 December 2015 October 2015 July 2015 June 2015 May 2015 April 2015 March 2015 February 2015 January 2015 December 2014 October 2014 September 2014 August 2014 July 2014 June 2014 May 2014 April 2014 March 2014 February 2014 January 2014 December 2013 November 2013 September 2013 July 2013 June 2013 May 2013 April 2013 March 2013 February 2013 January 2013 December 2012 November 2012 October 2012 September 2012 August 2012 July 2012 June 2012 May 2012 April 2012 March 2012 Categories Abnormal Return Access Alpha Amadeus Asset 4 ESG Audit Analytics Bankscope BETA CBS Company.Info Compustat CRSP Data management Data quality Datastream EDGAR Eikon Eurostat Excel Futures General Global Reporting Initiative GMID IBES IMF International Statistics LexisNexis National Statistics NYSE OECD Orbis Passport REACH S&P Indexes SDC Platinum SPSS Stata Stock index Sustainability Thomson One Volatitity Wharton World Bank Worldscope XBRL Zephyr Bitcoin exchange rate data The past year the digital currency Bitcoin has increasingly caught the eye of governments as well as the investment world.

This is in part because more and more online companies as well as regular companies are accepting bitcoins as payment.Bitcoin is actually an open source peer-to-peer electronic money and payment network introduced in 2008.Some limited research on the exchange has also been done by the Academic world.More information on it is widely available through Wikipedia and the Bitcoin website.The exchange rate of the Bitcoin to US Dollars, Euros and other currencies has been reaching extreme hights lately.It looks like the use and trading in bitcoins may be heavily influenced by speculators.If you want daily exchange rate data or even intraday data for the different exchanges or markets that handle trades, you can visit the website called Bitcoin charts.Using this website you can call up specific data on different currencies.General and recent information is available if you select a currency + market/exchange combination.More detailed data (including intraday data) can be called up by clicking the option “view larger chart” at the top left corner of the graph: Using the options in the tab “Pricechart” you can select the frequency, time period etc and draw a specific chart.