bitcoin price prediction august 2014

Mark Thomas Williams (born August 19, 1963) is an academic, financial author, columnist and risk management expert.He is a faculty member in the Finance Department at Boston University where he teaches courses in banking, risk management and capital market activities.In 2015, he co-authored a report with Harry Markopolos, the Bernie Madoff whistleblower about the growing risks associated with the MBTA pension.[1]Contents 1 2 3 4 5 In 1985, he earned a Bachelor of Science Degree in Business Administration from the University of Delaware.[2]He became a bank trust officer for Wilmington Trust Company and joined TD Banknorth in 1987.In 1993 he earned a Master of Business Administration from Boston University and joined the Federal Reserve Bank as an examiner in Boston and San Francisco.In 1997 he joined Citizens Power LLC, a Boston-based energy trading company and became a senior vice president, Head of Global Risk Management.[3]Since 2002, he has been on the faculty of Boston University as Executive-in-Residence/Master Lecturer.[4]

Williams is a member of the Standard & Poor’s Academic Council, a senior advisor at the Brattle Group[5] and is on the advisory board of Appleton Partners, a Boston-based private wealth management firm.[6],[17][18] and Business Insider.[19][20][21][22][23][24]He has also written articles for Bloomberg,[25] the Boston Globe,[26][27][28][29] Foreign Policy magazine[30] and The New York Times[31][32] He said in the testimony, "to transform Bitcoin into a virtual currency would require regulation, centralization, creation of a legal framework and strong regulatory oversight."He raised concerns about Bitcoin, including lack of consumer protection, it being a high-risk virtual commodity, having an artificially inflated price, extreme hoarding, hyped demand, high potential for market manipulation, and fraud.[33][34]On April 2, 2014, Williams provided congressional testimony before the U.S.House of Representatives Committee on Small Business discussing the 10 major risks associated with Bitcoin.[35]

On October 21, 2014 he presented on virtual currencies at The World Bank and on April 23, 2015 at the Bretton Woods Committee.[36]The Bitcoin community remains critical of his concerns.[37][38]Williams also continues to assert that the virtual currency is in a hyper bubble and will eventually suffer a price collapse.[37]In 2013, after Bitcoin peaked at $1,200, Williams predicted that it was in a bubble and would trade for less than 10 dollars by mid-2014.[39]On January 29, 2014, he provided risk testimony before the New York State Department of Financial Services hearing on virtual currencies.[40]Bitcoin prices dropped by over 50% but bottomed out above $200 through 2014 and didn't reached $10 like he said it would.[41]Other academics including Robert Shiller consider Bitcoin a speculative bubble.[42]^ ^ ^ /review/R1GGB6YXEBF9BZ ^ ^ /experts/mark-t-williams ^ ^ "MF Global Gives Fed a Lesson in How to Pick its Friends" The Financial Times - November 6, 2011 ^ "Few Silver Linings When Gold Bubble Bursts" The Financial Times - October 17, 2010 ^ "Ignore the hyperbole: America is not bust" The Financial Times - September 8, 2010 ^ "Why did the SEC fail to spot the Madoff case?"

Reuters - January 6, 2009 ^ "Minimizing exposure to investment management fraud" Reuters - December 15, 2008 ^ "Big banks aren’t bad banks" Reuters - February 2, 2010 ^ "Two Years After Lehman, Risk of Financial Collapse is Still High" Reuters - September 15, 2010 ^ "Is the Fed up to examining your trillion dollar bet?"

bitcoin exchange venezuelaReuters - January 30, 2009 ^ "Don’t give the Fed a new job" Reuters - July 16, 2009 ^ ^ "A Breach Of Fiduciary Duty At Bank Of America?"

bitcoin 30 day moving averageForbes - February 26, 2009 ^ "Subprime Market Debacle" Forbes - February 26, 2008 ^ /trumps-economic-plan-a-finance-professors-opinion-2016-10 ^ "Finance Professor: Mt Gox is Now a Fallen Tower of Sludge Business" Business Insider - February 25, 2014 ^ "Bitcoin Could Involve Into An Existential Threat Worthy Of A Science Fiction Movie" Business Insider - February 15, 2014 ^ ^ ^ ^ "Derivatives Trading Comes Clean in the Open: Mark T. Williams" Bloomberg - April 16, 2010 ^ ^ ^ "The weak link in bank reform" The Boston Globe - July 8, 2010 ^ "Don’t throw the keys to the Fed" The Boston Globe - July 2, 2009 ^ "Fool's Gold" Foreign Policy - November 8, 2010 ^ ^ ^ Testimony of Mark T. Williams The New York State Department of Financial Services: Hearing on Virtual Currencies - January 29, 2014.

bitcoin 30 day moving average

^ Panel 3: The Academic View on Virtual Currencies The New York State Department of Financial Services: Hearing on Virtual Currencies - January 29, 2014.^ [1] House Committee on Small Business: Committee Explores Risks and Benefits of Bitcoin Use by Small Businesses ^ ^ a b ^ ^ /williams-bitcoin-meltdown-10-2013-12 ^ http://www.dfs.ny.gov/about/hearings/vc_01282014/williams.pdf ^ /charts/bitstampUSD#rg60zczsg2014-1-1zeg2014-12-31ztgSzm1g10zm2g25zv ^ ^

ethereum holdingsLONDON 2016 could prove to be the year that the price of bitcoin surges again.

bitcoin average eurNot because of any dark-web drug-dealing or Russian ponzi scheme, but for an altogether less sensational reason - slower growth in the money supply.Bitcoin is a web-based "cryptocurrency" used to move money around quickly and anonymously with no need for a central authority.

bitcoin banco do brasil

But despite being championed by some as the digital money of the future, it is often dismissed as a currency that is too volatile to invest in.The reason 2016 looks set to be different is that bitcoin's price is likely to be driven in large part by similar factors to a traditional fiat currency, following the age-old principles of supply and demand.

bitcoin mudahInstead of being controlled by a central bank, bitcoin relies on so-called "mining" computers that validate blocks of transactions by competing to solve mathematical puzzles every 10 minutes.

dogecoin logoIn return, the first to solve the puzzle and thereby clear the transactions is currently rewarded with 25 new bitcoins, worth around $11,000 BTC=BTSP.

tips bitcoin billionaireBut when it was invented in 2008 by the mysterious "Satoshi Nakamoto", who has yet to be identified, the bitcoin program was designed so that the reward would be halved roughly every four years, in order to keep a lid on inflation.

The next time that is due to happen is July 2016.Bitcoin was also designed to emulate a commodity by having a finite supply of 21 million bitcoins, which will be reached in around 125 years, up from around 15 million today.Hence, also, the use of the term "mining".Daniel Masters, co-founder of Jersey-based Global Advisors' multi-million dollar bitcoin hedge fund, started his career as an oil trader at Shell in the mid-1980s and spent 30 years trading commodities before crossing over to bitcoin.Now he reckons the price of bitcoin could test its 2013 highs of above $1,100 next year and then pick up speed to rise to $4,400 by the end of 2017.That would be due to a number of factors, Masters said, including an increased acceptance of payments in bitcoin by big companies and authorities, rapidly growing interest and investment in the "blockchain" technology that underpins bitcoin transactions, and also more demand from China as its currency weakens and the economy slows.But taken in isolation, the halving of the mining reward will increase the price of bitcoin by around 50 percent from where it is now, Masters reckons.

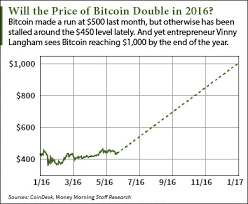

That is despite the fact that the halving of the reward has always been inevitable - a factor that would already have been accounted for in pretty much every other market."If OPEC (Organization of the Petroleum Exporting Countries)came out tomorrow and said, 'in six months' time we're going to halve oil production', the oil price would instantaneously react.But the bitcoin market is still in its infancy, and I don't think that factor is discounted into the price fully," he said.Bitcoin's price has already almost doubled in the last three months, putting it on track for its best quarter in two years.It hit $500 last month for the first time since August last year, with Chinese demand for a pyramid scheme set up by a Russian fraudster cited as a reason for the price surge.But Bobby Lee, the chief executive of one of the leading bitcoin exchanges in China, BTCC, reckons there is scope for the cryptocurrency to go much further.He thinks the price could increase by as much as eight times in the time up to the reward halving, taking it as high as $3,500 by next summer.