bitcoin pool vs solo

Jump to: navigation, search This article or section contains information that is no longer up-to-date.Please either update the outdated information or remove the outdated information.Although most miners prefer to mine in pools, there are still merits to solo mining.Contents 1 2 3 4 5 6 An article addressing the pros and cons of solo and pooled mining can often answer questions easier than simply asking in: #bitcoin-mining.Additionally, this page can serve as a reference for members of #bitcoin-mining to direct those with questions.The purpose of this page is to explain what the differences between pooled mining and solo mining.This Topic will give pros and cons of each to aid in the decision of a mining approach.Pooled mining "pools" all of the resources of the clients in that pool to generate the solution to a given block.When the pool solves a block, the 25 BTC generated by that block's solution is split and distributed between the pools participants.

Solo mining is when a miner performs the mining operations alone without joining a pool.All mined blocks are generated to the miner's credit.Pool Mining Pros Pooled mining generates a steadier income.Pooled mining can generate a 1-2% higher income (before fees, if any) due to long polling provided by the pools.Pool Mining Cons Pool mining can suffer interruptions from outages at the pool provider.Pools are subject to DOS attacks and have other downtimes, too.Backup pools and solo mining can be configured for these cases.Pooled mining tends to generate a smaller income due to fees being charged and transaction fees not being cashed out.There are zero fee pools.Until now, transaction fees are not cashed out by any pool.Pools might be part of attack scenarios.Solo Mining Pros Solo mining is less prone to outages resulting in higher uptime.Solo mining doesn't incur any fees.For each discovered block, 25 BTC and the transaction fees are paid to the miner.Solo Mining Cons Solo mining tends to generate more erratic income.

Solo mining wastes time due to only supporting getwork pull.Why pooled mining An article in favor of pooled mining.Bitcoin Sign up or log in to customize your list._ Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top up vote 2 down vote favorite 1 I would like to understand if there is a difference in resolving blocks with a private pool and solo mining, I understand that when solo mining you are given a block to resolve but within your private pool you may resolve various, this of course having several machines.

bitcoin dollar equivalentmining-pools miner-configuration solo-mining up vote 1 down vote There's no technical difference in generating blocks in pooling vs.

ethereum rig setupThe only difference is that pool mining can create a more steady pay flow.

ethereum eth or etc

Why do people do pooled mining?Bitcoin's difficulty can give unrealistic time frames for payout.The average computer will mine a single block in 1000+ years at current difficulty.But say I got into a pool with the average computer, I'd get a payed proportionally to the amount of work I contributed to a block being found.Although my "work contributed" may not end up being a block, it had a chance proportional to my own hash rate.

que es dinero virtual bitcoinIn the end I'd get payed a few satoshis daily as opposed to getting the block reward (25 BTC at the moment) at some random point in the future likely to be no later than 1000+ years from now.

bitcoin hyip investmentWhy do people do solo mining?

bitcoin nigeria exchangeThe main reason is because they can.

Certain miners have enough hash rate to get blocks in a reasonable time span.If I had a 1/144th the hash rate of the Bitcoin network I'd statistically have a 100% chance of finding a block of 25 BTC within 24 hours.There's no benefit for large miners to do pooled mining, may even hurt them because of fees.solo mining will theoretically yield the same amount of coins if difficulty and block reward never changed and you solo mined long enough.Although you should consider pooled mining if you aren't mining with a rack of gear.Your Answer Sign up or log in Sign up using Google Sign up using Email and Password Post as a guest Name Email discard By posting your answer, you agree to the privacy policy and terms of service.Not the answer you're looking for?Browse other questions tagged mining-pools miner-configuration solo-mining or ask your own question.Details Published: 30 June 2014 What's the best way to get a return when we mine Bitcoins?Should we mine on our own, mine with a small pool or mine with a large pool?

How much difference does it really make?Whether we want to be a gambler or an investor is really a question of how much risk we're prepared to take, but what are those risks and what are the odds of success?Before we can look at the odds of getting a particular return we need to establish a few starting conditions.Let's assume that we're planning to mine using hardware that, at the outset of our mining, is able to hash at 0.01% of the total global hash rate.If we have 120 PH/s of hashing then that means that we have 12 TH/s of hashing hardware, but if that global rate was 600 PH/s then we'd need 60 TH/s.The actual numbers don't matter though, just the percentages.We're going to assume that the network is expanding at 1% per day.For most of 2014 it has been above this but the trend is generally downwards and we need to assume something.At 1% per day then over 6 months (approximately 183 days) we'd see the global hash rate increase by a factor of 6.177 by the end, so our 0.01% of the network is only 0.0016188% after the 6 months.

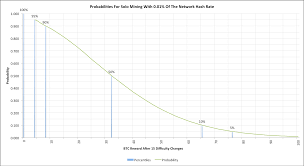

We're not expecting to add new capacity as we go though, so we only have the hardware that we start with.Bitcoin mining is highly erratic (see "Hash Rate Headaches") so it's not easy to calculate how our mining will progress so instead I built a Monte Carlo simulator.The results presented here all come from that simulation with 10M simulations of each scenario to ensure that the data is well smoothed.Let's start with the simplest case.We're going to assume that we'll use all of our hashing capacity to mine for blocks on our own.What might we expect?The chart shows 15 difficulty changes (6 months).It plots the cumulative probability of achieving a particular BTC reward.50% of miners will achieve 32 BTC or less at the end of the 6 months, while 5% will receive nothing at all!It's not possible to get smaller amounts in this time period by solo mining so that's why there's a discontinuity in the graph at the start.10% of miners will actually receive 65 BTC or more.The gambler in us might be attracted to the potential for high rewards; that part of us that wants to be an investor though is probably going to look at this graph in horror!

The easiest way to mitigate some of the risk is to join a mining pool.Let's ignore pool fees or anything that doesn't just give an equal share for hashing capacity provided to the pool.What might the same hardware achieve when run this way?Our gambler self may be disappointed to see that the potentially large payouts have vanished; 10% of miners will achieve 44 BTC or better.Our, more rational, investor self is probably much happer though as only 10% of miners achieve less than 26 BTC.The simple exercise of merging with a pool that has 10x the total mining capacity has made a huge difference to the variance of the mining rewards.Our 50% reward point is higher too (the chart shows 48% to keep things simpler)!Now that we can see the reduction in variance from using a mining pool we really need to ask questions about just how much does the mining pool size change the statistics.In order to do that we need to consider a few different ways to deploy our hardware.The following graph shows a much narrower span of BTC rewards.

It also shows the effects of mining as part of a pool controlling 0.1%, 1%, 10%, 25% and 50% of the global hash rate.That last one is sure to be controversial as a pool with 50% of the hash rate is deemed to pose a potentially serious risk, but rational miners have been keen to participate in such pools.Just how good are the reasons to do so?The first things to notice are just how bad the solo mining and 10% membership of 0.1% pool now look!The larger pools are definitely more attractive to anyone seeking predictable returns.In a simpler world the Bitcoin mining network might only be expanding very slowly and miners could attempt to allow time to smooth out the effects of mining variance.In practice though, as the network expands and the ever-increasing difficulty consumes the usefulness of any current hardware, then best known way to avoid the vagaries of random mining behaviour is to use large blocks of co-ordinated mining.Solo mining and mining in small pools is a strategy for gamblers, not investors.