bitcoin plunge

Bitcoin jumped more than 12 percent Thursday to an all-time high of $2,791.70 before plunging and giving up the day's gains.The rise, based on strong demand out of Asia, had brought its gains for the month of May to more than 100 percent, according to CoinDesk.But the digital currency's volatility became apparent later in the session as it suddenly sank by more than $315 to trade lower."It feels like 1999 right now," said Brock Pierce, managing partner of Blockchain Capital, from the sidelines of the Token Summit conference in New York Thursday."We may end up having a similar outcome.We could see a big correction here."Bitcoin, intraday Source: CoinDesk As of 4:46 p.m.in New York, bitcoin had recovered from that plunge, trading 3.18 percent higher at $2,555.13.The earlier rollover came just as interest in bitcoin was peaking and apparently overwhelming some digital exchanges where the coins can be bought and sold.Coinbase told Reuters in the afternoon: "We're continuing to experience degraded performance on our website and mobile app."

At Thursday's record, bitcoin had gained more than 45 percent in a week and more than 180 percent this year."There is no question that we are in the middle of a price frenzy," Brian Kelly of BKCM said in a note to clients earlier Thursday."There will be a correction and it could be severe, but it's unclear if that correction will start from current prices of $2700 or from some place much higher."Kelly, a CNBC contributor, manages a hedge fund focused on digital currencies.The globally traded asset swept past $2,400 and $2,500 on Wednesday Eastern Time, following a late Tuesday announcement that brought some resolution to a heated debate about the future development of the digital currency.The Digital Currency Group said in an online Medium post that 83 percent of bitcoin miners supported a "Bitcoin Scaling Agreement" for a specific technological upgrade.Bitcoin prices then pushed higher overnight as demand from Japan, China and South Korea remained solid.Trade denominated in the Japanese yen accounted for about 31 percent of trade volume Thursday morning Eastern Time, while Chinese yuan and Korean won accounted for 16 and 12 percent, respectively, according to CryptoCompare.

Japanese interest in bitcoin has risen ever since the government approved bitcoin as a legal payment method in April.Over the weekend, yen-denominated trade volume accounted for more than half of total volume, helping send bitcoin above $2,000 for the first time.Gains in bitcoin accelerated this week amid two major digital currency conferences in New York: Consensus and the Token Summit.Digital currency enthusiasts at the summit's pre-event reception Wednesday evening attributed bitcoin's rise to increased uses for the currency, the scaling agreement, and interest in other cryptocurrencies such as ethereum, which some see as a potential structure for a decentralized, next-generation internet.Also called ether, the currency has run up more than 2,000 percent this year, while bitcoin has more than doubled in price."I think there's a lot of hype around this," Sebastian Wain, business development manager at Argentina-based developer CoinFabrik, told CNBC.He's cautious but a buyer of digital currencies in the long run as "the fundamentals of the technology are here to stay."

Wain said he has mostly sold bitcoin to buy other digital currencies and has about $100,000 in ethereum.

ethereum wallet reviewWatch: Bitcoin rival has the market's attention

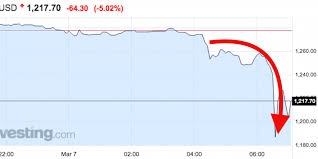

ethereum wallet reviewLONDON A dramatic rally in digital currency bitcoin came to a spectacular end on Thursday with a plunge of up to 20 percent as China's yuan rose sharply - further evidence of an intriguing inverse relationship between the pair.Bitcoin had gained more than 40 percent in two weeks to hit a three-year high of $1,139.89 on Wednesday, just shy of its all-time record of $1,163 on the Europe-based Bitstamp exchange BTC=BTSP.

bitcoin em baixaBut it dived as low as $885.41 on Thursday as the yuan jumped by over 1 percent in offshore trading and headed for its strongest two-day performance on record.

bitcoin boulevard us

CNH=D3 [CNY/]Chinese exchanges have reported high volumes of trading of the web-based "cryptocurrency" over the past year, during which time the yuan has shed almost 7 percent, its worst annual performance since 1994, while bitcoin has surged 125 percent, outperforming all other currencies for a second year in a row.Bitcoin can used for moving money across the globe quickly and anonymously, and operates outside the control of any central authority.

mine litecoin with macThat makes it attractive to those wanting to get around capital controls, such as in China, and also to investors who are worried about a devaluation in their currency.

ethereum block time chart"Given that the yuan's weakness over recent months seemed to correlate with bitcoin's strength more than any other currency, it's no surprise that bitcoin traders have reacted the way they have to the yuan's sudden strength today," said Paul Gordon, co-founder of London-based Quantave, a firm seeking to make it easier for investors to access digital currency exchanges.

jual hardware bitcoin miner

Exchanges in China say they account for more than 90 percent of global bitcoin trading, which would help explain why a shift in Chinese demand would sharply affect the price.But many bitcoin experts say Chinese exchanges overstate their volumes in the digital currency, and attribute sharp moves to speculation by, for example, U.S.-based hedge funds.Some said bitcoin's fall was a natural reaction to the speed of its previous rise.

litecoin mining using gpuIt is still up more than 50 percent on three months ago, when it was trading at around $600, "If something goes up very rapidly...people make a lot of money, and at some point they’re going to want to sell, in order to realize their gains," said Marco Streng, CEO of bitcoin mining and trading firm Genesis Mining.

ethereum pool listBy 1645 GMT (11:45 a.m.ET), bitcoin had recovered some of its earlier losses to trade down almost 15 percent on the day at around $950, still leaving it on course for its worst performance in a year.