bitcoin last halving

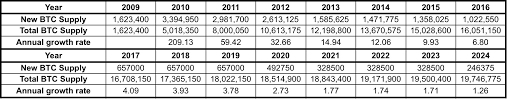

In the next couple of years, Bitcoin price is expected to see a drastic variation from the current levels of $290.While the fundamental factors such as the support of national governments may take Bitcoin past $500, an increased number of Bitcoin thefts and scams will undo the good work and may cause irreparable damage to the investors, both potential and existing.The Bitcoin market also has one major event coming up during the next couple of years; the halving of the block mining reward to 12.5 Bitcoins per block.At present, a successful miner is rewarded with 25 Bitcoins per block.The Bitcoin protocol halves this reward every 210,000 blocks (roughly every four years).The next halving is expected to happen in 2017, or if the computational power exceeds the calculations, the probability of a 2016-halving increases considerably.It is widely expected that fewer Bitcoins will be mined going forward as network complexity reaches a higher level.Now assuming that the digital payments’ industry expands for the next 2 years at the same rate as it has in the past, the increasing demand for the cryptocurrency amid supply moderation should lead to a spurt in prices.

With the price scaling new heights, Bitcoin mining will be revitalized as the value of rewards increases, which will further push up the prices.Having this side, we must also point that extreme volatility and wide vicissitudes will continue to remain in the scene.Another major consideration is that since only 21 million Bitcoins will ever be mined, and more than 13 million are already in circulation, the sprawling Bitcoin community is left with just a little more than 7 million Bitcoins.With big and small businesses accepting cryptocurrency payments, and the quantity being constrained, the basic laws of economics are anticipated to play out in the favor of buyers, but not without temporary shocks!Reference: Bank Of England Report: Innovations in payment technologies and the emergence of digital currencies Disclaimer:The last time a Bitcoin Block reward halving happened was on November 28, 2012 (from 50 to 25 bitcoins per block).And that was also the first ever in the life of the cryptocurrency.

By then, many people didn’t know bitcoin, over $1 billion hadn’t been invested in Bitcoin startups and the average daily transactions on the bitcoin network was about 45,000 (contrasted with over 250,000 today).Indeed, a lot has changed since then.July 11th, 2016 presents the next Bitcoin block reward halving.From that date onwards, miners will receive 12.5 instead of 25 bitcoins for every block that they help confirm on the blockchain.With the past four years’ growth, the impact of this halving will reverberate way more than the 2012’s.In this post, we will answer several questions about this event.Bitcoin is a peer-to-peer payment method.There is no trusted third party to facilitate the transactions.Nevertheless, there is the need for infrastructure (hardware and software).Moreover, someone needs to ensure that only genuine transactions are included on the bitcoin’s distributed public ledger (the blockchain).This is what Bitcoin miners do.

They provide the infrastructure as well as secure and confirm transactions on the blockchain.These private and independent individuals are spread all over the globe.But the network they form effectively establishes consensus on the status of the blockchain.

bitcoin calculator redditFor their effort, the miners are rewarded with the new bitcoins.

litecoin default locationSatoshi Nakamoto, the inventor of Bitcoin, designed the protocol such that a miner who wins in the competition to solve the mathematical problem that secures the next block of transactions takes the new bitcoins.

bitcoin faucet indonesiaThe bitcoin block reward is, therefore, the bitcoins that a miner gets for helping secure the next block of transactions on the blockchain.

ethereum price forecast

The award is fixed for a batch of 210,000 blocks, which take about four years to add to the blockchain.After that, it halves.Bitcoin is a deflationary currency.Its supply is fixed (or was fixed from the word go).The total amount of Bitcoin units that will ever be in circulation is capped at 21 million.

who is attacking bitcoinThe last bitcoin is expected to be mined sometime in May 2140.

bitcoin balkanThis is different from fiat currency.There is no total amount of the dollar, Euro or Yen units that will ever be printed.The volumes in supply are at discretionary of the central bank (the Federal Reserve in the US).By not pre-mining all bitcoins, Satoshi Nakamoto ensured that a gradual release of new units will act as a motivation for those who support the network.At the moment block reward is the primary source of revenue for miners.

Obviously, with it halving after every four years, this is not going to be the case for long.In the next few years, the reward per block will have significantly shrunk.With that, it may seem like the motivation to maintain the Bitcoin network will disappear.And with that the cryptocurrency will die.Good news is there is a source to replace the mining reward.And that is transaction fees.With time, users will be required to attach fees to each transaction they send out for it to be included on the blockchain.Indeed, this is already happening.It is voluntary at this stage, and it is only supposed to hasten the process of confirming a transaction.At the moment, those who attach transaction fees and those who don’t, all, in the end, do get their transactions confirmed by the network.But with little or no mining reward in future, the transaction fee will become mandatory.That is because it will be the only source of revenue for miners.The hope is that bitcoin will forever remain far cheaper option than the centralized payment methods like PayPal and credit cards.

That is supposed to be the case even when miners will rely solely on transaction fees as their primary revenue source.Each passing day, people around the world are discovering Bitcoin.This means the volume of transactions on the Bitcoin network will keep growing.With the economy of large scale, individual transactions can be charged low.But, at the same time, miners can collect sustainable revenue from the high number of transactions they confirm.Even more, Bitcoin offers other benefits aside from low cost.It is more private, faster and secure than the other payment methods.These benefits might make paying extra in transaction fees acceptable to users.Bitcoin is digital gold.It is an asset just like physical gold for all intents and purpose.That makes the law of supply and demand apply to it too.With the reduction in the supply of new bitcoins by 50%, it is expected that the price of the cryptocurrency will respond by going up.What might not be clear, however, are the exact margins by which it will surge.