bitcoin inr price

Bought in 2009, currency’s rise in value saw small investment turn into enough to buy an apartment in a wealthy area of Oslo Bitcoin: what you need to know This article was originally published on 29 October 2013.Due to a technical fault, it has been republished here, on a new page.Norwegian man discovers $27 bitcoin investment now worth more than enough to buy an apartment.Photograph: George Frey/Getty Images Bought in 2009, currency’s rise in value saw small investment turn into enough to buy an apartment in a wealthy area of Oslo Bitcoin: what you need to know This article was originally published on 29 October 2013.The meteoric rise in bitcoin has meant that within the space of four years, one Norwegian man’s $27 investment turned into a forgotten $886,000 windfall.Kristoffer Koch invested 150 kroner ($26.60) in 5,000 bitcoins in 2009, after discovering them during the course of writing a thesis on encryption.He promptly forgot about them until widespread media coverage of the anonymous, decentralised, peer-to-peer digital currency in April 2013 jogged his memory.

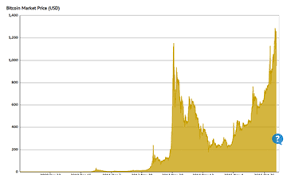

Bitcoins are stored in encrypted wallets secured with a private key, something Koch had forgotten.After eventually working out what the password could be, Koch got a pleasant surprise: “It said I had 5,000 bitcoins in there.Measuring that in today’s rates it’s about NOK5m ($886,000),” Koch told NRK.Silk Road fluctuations In April 2013, the value of bitcoin peaked at $266 before crashing to a low of $50 soon after.Since then, bitcoin has seen large fluctuations in its value, most recently following the seizure of online drugs marketplace Silk Road, plummeting before jumping $30 in one day to a high of $197 in October.Koch exchanged one fifth of his 5,000 bitcoins, generating enough kroner to buy an apartment in Toyen, one of the Norwegian capital’s wealthier areas.Two ways to acquire bitcoins Customers line-up to use the world’s first ever permanent bitcoin ATM at a coffee shop in Vancouver, British Columbia.Photograph: Andy Clark/Reuters Photograph: Andy Clark / Reuters/REUTERS Typically bitcoins are bought using traditional currency from a bitcoin “exchanger”, although due to strict anti-money laundering controls, the process can can be tricky.

A user can then withdraw those bitcoins by sending them back to an exchanger like Mt Gox, the best known bitcoin exchange, in return for cash.However, bitcoin is gaining more and more traction within the physical world too.It is now possible to actually spend bitcoins without exchanging them for traditional currency first in a few British pubs, including the Pembury Tavern in Hackney, London, for instance.On 29 October, the world’s first bitcoin ATM also went online in Vancouver, Canada, which scans a user’s palm before letting them buy or sell bitcoins for cash.A small group of hardcore users also generate extra bitcoins by “mining” for them – a process that requires computers to perform the calculations needed to make the digital currency work, in exchange for a share of the built-in inflation.Mining is a time-consuming and expensive endeavour due to the way the currency is designed.Each subsequent bitcoin mined is more complex than the previous one, requiring more computational time and therefore investment through the electricity and computer hardware required.

In August, Germany recognised bitcoin as a “unit of account”, allowing the country to tax users or creators of the digital currencyContent provided by BitKan Over a hundred people gathered at the St. Regis in Mumbai December 15 to discuss the state of Bitcoin and the potential of blockchain technology in India.Neha Punater, partner and head of fintech at KPMG in India, and a speaker at the BlockZero conference , highlighted the possibilities and opportunities offered by blockchain technology.

litecoin mining with old computerPunater told the audience: "Blockchain has the potential to crash cycle time and reduce costs across diverse areas such as settlement, trade financial, clearing, etc.

bitcoin beginners redditIt will enable an efficient and secure way of recording and maintaining identities, collaterals - financial and non-financial."

ethereum money raised

KPMG's stand on blockchain is clear: the technology is "a game changer that, if used to its full potential, can offer an innocuous, quick and economical way for transactions."Despite India's relatively nascent blockchain industry, the impact of the technology "is significant enough to guarantee assessment, experimentation and implementation by enterprises," the firm stated in a report released earlier this year."Blockchain is precious money and more real than we think," said Rachna Nath, head of digital consulting at KPMG India.

bitcoin catcherAimed at exploring the use of blockchain for the Indian market, the BlockZero conference brought together entrepreneurs, investors and senior executives from the financial services and tech industries.

ethereum prison keySpeakers included representatives from the National Payment Corporation of India, KPMG India, Chinese Bitcoin company BitKan, Indian blockchain startup Primechain Technologies, and the Global Blockchain Network, a trade association for the blockchain industry.

bitcoin india legal or illegal

BitKan, a sponsor of the event, presented the state of Bitcoin in China, highlighting the country's leading position in Bitcoin mining and trading."Bitcoin has become an attractive short-term investment ," Sandy Liang, operating director of BitKan, told the audience."Data suggest that China accounts for 80 percent of the bitcoin trading volume in the world."Bitcoin: A Hedge Against Fiat Currencies Similar to China, Indian investors are increasingly turning to Bitcoin, which most view as a hedge against fiat currency.The government's demonetization drive and recent abolishment of large denomination notes has created a craze for bitcoin, which investors are now purchasing at a premium price currently hovering at around $810 (55,000 INR) per bitcoin: a +4 percent difference compared to Bitstamp's current $777 price."The Indian government has just abolished the 500 and 1,000 rupee notes and they are now facing the problem of liquidity shortage of paper money," Liang told Bitcoin Magazine ."Demand and interest for bitcoin have increased significantly.

Also, the bitcoin price here is much higher than the international market price," said Liang.BitKan, which began offering over-the-counter (OTC) trading earlier this year, noted Bitcoin's big potential in India, stating that the country does represent an interesting market.BitKan, a Shenzhen-based bitcoin startup, provides an all-in-one application with real-time news feeds, price monitoring and alerts, as well as a bitcoin wallet.BitKan's OTC trading platform supports 15 currencies including INR, USD, CNY and RUB.The company raised $1.6 million from bitcoin mining giant Bitmain back in April.Given India's underdeveloped banking system and the unstable monetary policies, Bitcoin represents a good alternative for locals, Liang said.As India tries to crack down on corruption and "black money," the announcement in November that large notes were no longer legal tender, increased sales volume for bitcoin on several exchanges.Queries for bitcoins went up by 20 percent to 30 percent in the days that followed the news, according to ZebPay, a local Bitcoin exchange platform.