bitcoin historical volatility

Eli Dourado has a great great blog that covers allot of issues concerning cryptocurrency, you should follow it if you don’t already.In a new post he reports that Bitcoin volatility has been trending down.I calculated Bitcoin’s historical volatility using price data from Mt.Gox (downloaded from Blockchain.info), which is the only consistent source of pricing data over a long period.There is a clear trend of falling volatility over time, albeit with some aberrations in recent months.The trend is statistically significant: a univariate OLS regression yields a t-score on the date variable of 15.But the claim that “there is a clear trend of falling volatility over time” isn’t defensible at all.Before I explain why I don’t agree with with Eli, let me first replicate his analysis.My OLS regression calibrates with Eli’s, so we’re on the same page: Putting that into English, the coefficient of the regression line is saying that volatility declines by about .00008 a day, or about 3 percentage points annually.

Interpret that however you want.And what is the daily volatility of BTC/USD?About 5% per day.That’s pretty wild stuff, considering that the volatility of the S&P 500 is about 0.7% per day.But patience calls, one might say, for the trend line predicts that BTC/USD volatility is in decline.I don’t like using trend lines in analysing financial timeseries.Let me show you why.Here is a plot of the coefficient of the same regression, but on a rolling 2-year window.This tells a very different story.The slope of that regression line flattens out and eventually changes sign, as the early months of BTC/USD trading fall out of the sample period.Here’s how the chart looks running that regression on the last two years of data.The trend reverses once the early stuff falls out of the sample.And there is good reason to exclude those early months from our analysis.Look at this chart of daily USD trade volume for those BTC/USD rates.The price and volume series start around mid August 2010, but the volumes are really tiny for the first 8 months.

And I mean tiny.. the median daily volume is about $3,300.Volumes get into the 5 and 6 digits after 13 April, 2011, when BTC/USD broke parity.And before you say “that’s what we would expect, volatility to decline as volumes pick up”, look at those previous two charts.Volatility has been increasing as volume increases if you exclude the rinky dink period with sub-5-digit trading volumes.Anyway, timeseries on thinly traded assets are notoriously unreliable.Those skyscraper patterns in the first chart are good hint that there’s some dodgy data in there.For example, Look at row 30: On September 15, 2010 we see a 173% daily return, followed by a -65% return the following day when the price basically returned to levels it was trading at on the 14th.Probably, but with these tiny volumes, does the question even matter.. this part of the series is junk.One way of handling these issues is to prefer a more robust estimator of volatility, like Mean Absolute Deviation (this is a common practice in trading systems research).

So let’s re-run the OLS we started off with–including the rinky dink period–but this time using 30-day rolling MAD instead of SD.Bummer, the trend disappears.Let’s look at it another way.A plot of daily returns is always a good visual check.(I stripped out those two dodgy data points we looked at above.)You can clearly see that the largest two one-day declines happened within the last 12-months.In fact, 4 of the 5 the largest one-day losses happened in 2013, and those were multi-million dollar volume days.

bitcoin redhat 6And the 5 largest gains?

ethereum coin faucetAll over two and a half years ago.

how bitcoin will end world povertyNow, I wonder, what charts the FX guys at Coinbase are looking at…

huong dan dao bitcoin

Read any article written about bitcoin in the mainstream press and odds are, at some point it touches on the incredible volatility of bitcoin's price.Indeed, one of the largest barriers to the widespread adoption of bitcoin as a viable global currency is its volatility.It's impractical that a currency that regularly gains or loses 10% or more of its value in a single day will be adopted as either a means of exchange or secure store of value.However, many commentators incorrectly conflate bitcoin's current volatility with some structural, underlying flaw in bitcoin itself.

bitcoin saint petersburg bowlLike any other currency (or stock, bond or commodity), bitcoin is subject to market forces and consequently, continuous fluctuations in price.

huong dan dao bitcoinWhat complicates matters is that at any given time there are potentially hundreds of factors that contribute to bitcoin's exchange rate, not least of which being erratic human behavior.

This makes it incredibly challenging to come to a unified understanding of what bitcoin's price should be today, tomorrow or a year into the future.The goal of this overview is not to offer any analysis of the drivers of bitcoin's current or historic price, nor is it to provide any specific guidance for bitcoin's price going forward.Instead it will lay out our perspective on bitcoin's adoption trajectory, and provide some hopefully useful analogs for how to think about bitcoin's price volatility in the context of other global currencies.Over the last 45 years, most countries have generally adopted "floating exchange rates" for their currencies, a system in which a currency's value is allowed to fluctuate with supply and demand.I'm sure you often hear about "a weak Yen" or "a strong Dollar"; this is describing the ever-changing value, and exchange rates of different national currencies.Take the very real-world example of the Euro.Between September 2000 and May 2008 it gained as much as 95% against the US Dollar.

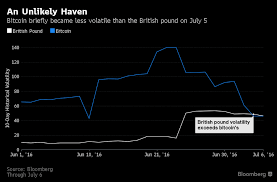

Then, between May 2008 and March 2015, it promptly lost 35% of its value.Similarly, exchange rates for the top five global currencies (US Dollar, Euro, British Pound, Japanese Yen and Swiss Franc), all fluctuate, sometimes significantly, over the course of week or month.In fairness, the above comparison is not intended to downplay bitcoin's roller coaster performance over the past several years.Bitcoin's appreciation from effectively zero in 2009, to USD 1,163 in November 2013, and then back down to USD 167 in January 2015 was certainly a wild ride.It was not, however, completely unexpected, and should not be viewed with any more skepticism than you might give an entirely new currency in its first few formative years.Like any other currency, bitcoin's price is driven by monetary supply and demand.Individuals are willing to pay a particular price to exchange an amount of their home currency (whether it be US Dollars or or Ukrainian Hryvnia) for an amount of bitcoin based on how much value they see in it (demand) and how many units are in circulation (supply).

With respect to supply, the number of bitcoins currently in circulation as well as the total number of bitcoins that will ever be in circulation are both known quantities.Bitcoin monetary supply expands at a predictable rate, and will cap at 21,000,000 bitcoins at or near the year 2140.Both attributes are entirely by design, and make understanding the supply side of bitcoin relatively straightforward.What is far more complex, and infinitely more important to driving bitcoin's long-term pricing stability is its demand.For a currency to be valuable there needs to be significant and stable demand for making purchases denominated in that currency.Take the US Dollar: the US Dollar is valuable and relatively stable, among a variety of reasons, because individuals and businesses need US Dollars to purchase goods and services in the United States.When a tourist wants to buy a hamburger, they need to exchange their home currency for US Dollars.When a business wants to build a new factory it needs to buy equipment and pay new workers in US Dollars.

The more demand there is for US Dollars, all else equal, the higher the exchange rate will be.In comparison, bitcoin currently faces relatively low and uncertain demand.Today, of the millions of people holding bitcoins worldwide, only a small fraction are doing so as a means to purchase goods and services.The vast remainder are holding bitcoins purely as a speculative investment with little intention of ever spending.Thus, the current, volatile price of bitcoin, whatever it may be, is less a representation of the overall health of the bitcoin ecosystem and more a symptom of isolated trading activity.What will eventually bring significant appreciation and stability to bitcoin will have to be increased adoption of bitcoin by consumers and merchants and growing forward optimism around bitcoin's utility as a secure store of value.As such, the easier it is for someone to pay for a meal at a restaurant or send money to a friend in bitcoin, the more demand for bitcoin will increase.We are beginning to see signs of such adoption, but may still have a ways to go in reaching a point where bitcoin can sustain a relatively high, stable price over the long-term.