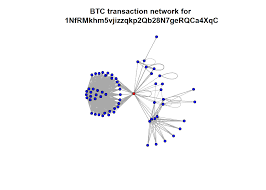

bitcoin graph november 2013

Home/Magazine Archive/April 2016 (Vol.4)/A Fistful of Bitcoins: Characterizing Payments among.../Abstract Print Mobile App ACM Digital Library In the Digital Edition Send by email Share on reddit Share on StumbleUpon Bitcoin is a purely online virtual currency, unbacked by either physical commodities or sovereign obligation; instead, it relies on a combination of cryptographic protection and a peer-to-peer protocol for witnessing settlements.Consequently, Bitcoin has the unintuitive property that while the ownership of money is implicitly anonymous, its flow is globally visible.In this paper we explore this unique characteristic further, using heuristic clustering to group Bitcoin wallets based on evidence of shared authority, and then using re-identification attacks (i.e., empirical purchasing of goods and services) to classify the operators of those clusters.From this analysis, we consider the challenges for those seeking to use Bitcoin for criminal or fraudulent purposes at scale.

Back to Top 1.Introduction Demand for low friction e-commerce of various kinds has driven a proliferation in online payment systems over the last decade.Thus, in addition to established payment card networks (e.g., Visa and Mastercard), a broad range of the so-called "alternative payments" has emerged including eWallets (e.g., Paypal, Google Checkout, and WebMoney), direct debit systems (typically via ACH, such as eBillMe), money transfer systems (e.g., Moneygram), and so on.However, virtually all of these systems have the property that they are denominated in existing fiat currencies (e.g., dollars), explicitly identify the payer in transactions, and are centrally or quasi-centrally administered.(In particular, there is a central controlling authority who has the technical and legal capacity to tie a transaction back to a pair of individuals.)No entries found Log in to Read the Full Article Sign In Username Password Forgot Password?Sign In Need Access?Create a Web AccountCreate a Web AccountJoin the ACMBecome a Member Subscribe to Communications of the ACM MagazineGet a SubscriptionPurchase the Article Purchase This Article User Name Password » Forgot Password?

» Create an ACM Web Account Sign InBitcoin’s price has taken off again, forcing some to defend the value of the currency as utterly un-bubblish.This becomes a humorous exercise.The finance nerd community (of which I’m not nearly good enough to be a member) is done talking about the Trillion Dollar Coin for now, so it’s back on the Bitcoin bus.Bitcoin is trading at record price points, currently clocking in at around $264 USD per coin.

cnn dinero bitcoinTo put that price point in perspective, in April Bitcoin spiked to around $237.

kiếm bitcoin miễn phí nhanhIt then fell all the way to around $69 in July.

bitcoin money laundering ukAnd now we are back north of the $200 mark, rapidly approaching the $300 ceiling.

irish bitcoin exchange

People keep saying this isn’t a bubble, and it confuses me.Of course this is a bubble.It’s a far too rapid increase in the price of a financial instrument that is unmoored from any inherent value that is being bid up by aggressive individual speculation.What else is that?Joe Weisenthal, better known as @TheStalwart, called Bitcoin a joke today, making the following key point: “The currency has been surging several percent every day lately, and that’s evidence that it’s not in a bubble?” Bingo.

bitcoin core syncBut there is another point that is worth keeping in mind.

bitcoin gospelIt appears that Bitcoin is currently seeing its value break ranks with its transaction volume.This is not what we have seen in the past, when the two were in loose unison.Here are two charts, the first showing the price of a single Bitcoin in USD, and the second showing Bitcoin transactions per day.

Follow both from left to right, and see if you can feel the change: What’s going on?We can’t be sure, but I think that the shuttering of Silk Road has led to a meaningful decline in Bitcoin transactions.However, speculative spirit is driving the price of the currency higher.So, the current boom is even more bubblish than before, when the price rose before, and then cratered, mostly tied to rising and falling volume.Bitcoin can have ‘value’ based not on any sort of government backing or the like, but it can provide short-term utility to all holders if it has use.But if use is in decline, its value should follow.To see its value rise as its use declines is simply odd.Top Image Credit: FlickrMy analysis work would never have even started without the very many websites that report on the state of the Bitcoin ecosystem.Some of my favourites are: Not a definitive list of research papers, but some of the more interesting ones I've found.These aren't all Bitcoin papers, but all have something interesting to say about things related to cryptocurrency designs.

Bitcoin is a new digital currency that is open source, distributed, and has no central issuing authority.It is not backed by anything physical, like gold, yet it has been designed so that only a fixed number of bitcoins can ever be created.Bitcoins and bitcoin transactions are protected from counterfeiting and double spending by strong cryptography.Because there is no issuing authority, there are no fees for transactions, although fees may be charged for changing into other currencies, escrow services, etc. Like gold, bitcoin is a form of free market money: money chosen by the people who use it because it suits their needs, rather than being money because some government decrees that its subjects shall use it, and backs up that order with force if necessary (legal tender laws).Being a very young money, bitcoin does not have a very stable value.As you can see on the logarithmic chart below, one bitcoin is now worth 100s of times what it was worth two years ago, and 10s of times what it was worth one year ago.

This is because while the number of bitcoins is growing quite slowly, the number of users, and the number of transactions using bitcoins, is growing rapidly, causing demand to outstrip supply.Because it is a young currency, bitcoin has had various "teething" problems, and some of these have caused wild swings in value.As the software is refined, as more vendors start accepting bitcoin, and more users choose it for their transactions, these wild swings should damp out.Over the next 10 years or so, the number of bitcoins in circulation will approach its final total, roughly double the number in the market now.But the number of users may well go from hundreds of thousands to millions, or even hundreds of millions… which means the value of bitcoins has a lot of upside.On the other hand, it is entirely possible that some flaw in the system may come to light, rendering bitcoins completely worthless.In any event, it is wonderful to see new forms of free market money offering choices for saving and facilitating trade.