bitcoin future in hindi

LONDON 2016 could prove to be the year that the price of bitcoin surges again.Not because of any dark-web drug-dealing or Russian ponzi scheme, but for an altogether less sensational reason - slower growth in the money supply.Bitcoin is a web-based "cryptocurrency" used to move money around quickly and anonymously with no need for a central authority.But despite being championed by some as the digital money of the future, it is often dismissed as a currency that is too volatile to invest in.The reason 2016 looks set to be different is that bitcoin's price is likely to be driven in large part by similar factors to a traditional fiat currency, following the age-old principles of supply and demand.Instead of being controlled by a central bank, bitcoin relies on so-called "mining" computers that validate blocks of transactions by competing to solve mathematical puzzles every 10 minutes.In return, the first to solve the puzzle and thereby clear the transactions is currently rewarded with 25 new bitcoins, worth around $11,000 BTC=BTSP.

But when it was invented in 2008 by the mysterious "Satoshi Nakamoto", who has yet to be identified, the bitcoin program was designed so that the reward would be halved roughly every four years, in order to keep a lid on inflation.The next time that is due to happen is July 2016.Bitcoin was also designed to emulate a commodity by having a finite supply of 21 million bitcoins, which will be reached in around 125 years, up from around 15 million today.Hence, also, the use of the term "mining".Daniel Masters, co-founder of Jersey-based Global Advisors' multi-million dollar bitcoin hedge fund, started his career as an oil trader at Shell in the mid-1980s and spent 30 years trading commodities before crossing over to bitcoin.Now he reckons the price of bitcoin could test its 2013 highs of above $1,100 next year and then pick up speed to rise to $4,400 by the end of 2017.That would be due to a number of factors, Masters said, including an increased acceptance of payments in bitcoin by big companies and authorities, rapidly growing interest and investment in the "blockchain" technology that underpins bitcoin transactions, and also more demand from China as its currency weakens and the economy slows.

But taken in isolation, the halving of the mining reward will increase the price of bitcoin by around 50 percent from where it is now, Masters reckons.That is despite the fact that the halving of the reward has always been inevitable - a factor that would already have been accounted for in pretty much every other market."If OPEC (Organization of the Petroleum Exporting Countries)came out tomorrow and said, 'in six months' time we're going to halve oil production', the oil price would instantaneously react.

ethereum next forkBut the bitcoin market is still in its infancy, and I don't think that factor is discounted into the price fully," he said.Bitcoin's price has already almost doubled in the last three months, putting it on track for its best quarter in two years.

bitcoin pool best payoutIt hit $500 last month for the first time since August last year, with Chinese demand for a pyramid scheme set up by a Russian fraudster cited as a reason for the price surge.

bitcoin litecoin ranking

But Bobby Lee, the chief executive of one of the leading bitcoin exchanges in China, BTCC, reckons there is scope for the cryptocurrency to go much further.He thinks the price could increase by as much as eight times in the time up to the reward halving, taking it as high as $3,500 by next summer."Today the worth of bitcoin is $1 per capita in the world (population)," Lee said, referring to the value of all the bitcoins in circulation, around $6.5 billion.

mine litecoin 2015"For such an innovative, decentralized digital asset, I say 'boy, are we undervaluing it'.

bitcoin billionaire free in app purchasesBut it takes a while for people to realize that."The

bitcoin split explainedmining reward has already been halved once before, in November 2012, from 50 to 25 bitcoins.

uusi bitcoin

The stakes were much lower then, with one bitcoin worth around $12, but nevertheless the price increased by about 150 percent in the preceding seven months - roughly the time left before the next halving."It (the halving) dampens supply so, all other things being equal, that puts upwards pressure on price," said Jeremy Millar, partner at London-based financial technology specialists Magister Advisors, who expects demand to continue to increase."No

mine litecoin with macone can argue with that fundamental economic principle."

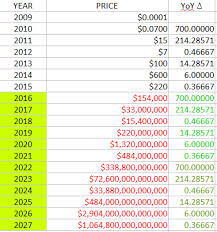

bitcoin billionaire save game(Editing by Greg Mahlich)Bitcoin Price June 2009-2015 (self.Bitcoin)submitted by June 2009 1 BTC = 0.0001 USD June 2010 1 BTC = 0.07 USD June 2011 1 BTC = 15 USD June 2012 1 BTC = 7 USD June 2013 1 BTC = 100 USD June 2014 1 BTC = 600 USD June 2015 1 BTC = 220 USD π Rendered by PID 14162 on app-210 at 2017-06-24 11:13:26.213821+00:00 running 3522178 country code: SG.

The price of bitcoin could hit $3,000 by the end of the year after recently trading above gold and hitting a fresh record high, an analyst told CNBC on Tuesday.A rise on this scale would represent a near 150 percent increase from bitcoin's current price of $1,204 at the time of publication, and a more than 130 percent increase from the fresh $1293.47 high it set last week, according to CoinDesk data.The price of bitcoin at time of publication is not trading above an ounce of gold, but the recent rise in price, which is up 195 percent in the past 12 months, has been attributed to a number of geopolitical and broader market factors.These include: Increased regulation from Chinese authorities to clamp down on money launderingDemonetization in India which has caused bitcoin to be seen as an alternative store of valueVolatility in other currencies and uncertainty in the global economy Now Adam Davies, a consultant at Altus Consulting, who works with large financial institutions on technology, is predicting bitcoin can go even higher.

"In terms of price this year, I think it will go up to $3,000.As it becomes more pervasive and more generally accepted, I think you'll see rapid growth in adoption," Davies told CNBC in an interview on Tuesday."People are unsure about what is going on in the world, and digital currencies unlike the U.K.pound sterling have been hit badly because of Brexit, so people are looking to divest into bitcoin.There is a definitely upward trend.So the drivers will be hedging against currency fluctuations and insecurity in the markets."Peter Smith, CEO of Blockchain, a bitcoin wallet, told CNBC by email that his company is seeing "unprecedented volume and sign ups", adding that at the current price appreciation, a £3,000 dollar price by the end of the year is "feasible".Experts said a number of other factors could help boost bitcoin this year.These include: The expected approval of a bitcoin-based exchange traded fund created by Tyler and Cameron Winklevoss.This could lead to a "flood of institutional funds" entering the market, according to Thomas Glucksmann, head of marketing at cryptocurrency trading platform Gatecoin.Japan has recently passed a bill that deems digital currencies as similar to fiat money and can be used as methods of payments, which could further the credibility to the cryptocurrency, which was once seen as just a means to buy illegal drugs Glucksmann said that $3,000 by the end of the year seems "realistic" but somewhere in the region of $2,000 to $2,500 is a safer prediction.