bitcoin fork value

Bitcoin is at a pivotal and somewhat misunderstood moment.In the following article, we look at the proposed hard fork and what the implications may be.The Bitcoin community –consisting of customers, exchanges, wallets, businesses, developers and miners– has for years been involved in what is known as the .Bitcoin, in its current form, can only handle a certain amount of transactions.The Bitcoin network has, however, been growing in popularity and used at such a rate that transacting has become painfully slow and much more expensive than it had been a few years ago.Since Bitcoin is software built on open protocols and consensus, any developer (or groups of developers) can propose and improvements to the technology.Bitcoin can vote on these changes and whether or not they want to implement them, and Bitcoin users can decide whether to follow them or not.If the proposed changes are significant enough, it results in a new version of the software, which may not be fully compatible with the old.

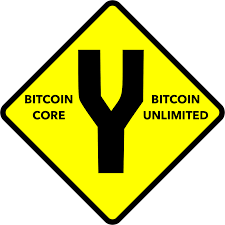

If the change is controversial in the Bitcoin community, the new version then “forks” from the main branch and operates by the newly implemented rules.In recent months, one of these proposals, known as Bitcoin Unlimited, has been growing in popularity and miner support.plans to increase the block size limit to allow for more transactions to be processed simultaneously than the current version of the software, known as Bitcoin Core.

steam wallet code bitcoinIf you have ten Bitcoin (10 BTC) before the hard fork, you will have a balance of 10 Bitcoin Core 10 Bitcoin Unlimited after the fork.

bitcoin paper trailSince this isn’t the first time that a cryptocurrency has forked, we have an idea of what to expect to happen: The hard fork split of a cryptocurrency into two new chains is a very technical matter.

50 mh/s bitcoin

It is crucial that you store your Bitcoin with a reputable Bitcoin platform with a large, technical and world-class measures, such as Luno.Members of the Bitcoin Unlimited development team have stated that since Bitcoin miners provide security and oversight to the blockchain, the fork will only be considered after it receives more than 75% mining support.

usb bitcoin farmSupport for the different Bitcoin proposals can be seen here: Despite the Bitcoin Unlimited proposal gaining popularity, there is no defined date or guarantees that it will happen at all.

litecoin cambioWe support the debate and majority consensus model which underpin and improve Bitcoin.

ethereum backed byOur main goals are to keep our customers’ money safe and to maintain an orderly, useful and simple Bitcoin market in the we operate in.

We will support –buying, selling, receiving, sending, storing and trading– the version that enjoys majority support from the Bitcoin community of customers, miners, wallets and exchanges.We may decide, based on market conditions, to support just one or both versions or to discontinue support for a certain version in the future.Should we decide to only support one currency, we will create a mechanism for our customers to withdraw the balance or value of the other version to a compatible platform.This is yet another exciting and defining moment in Bitcoin’s evolution.We’ll be working with the greater Bitcoin community to ensure a stable transition of any current and future hard forks.We sent out a simple survey using 21.co/blockchain to find out what key influencers in the community think.The topic of the hour is the possibility of a Bitcoin hard fork.Without taking any position on the issue, we used the 21.co/blockchain list to quickly survey a group of people generally held to be influential in the broad Blockchain ecosystem for their perspectives.

The list includes Bitcoin Core developers and Bitcoin Unlimited supporters, as well as a host of investors, executives, and founders.We’ve reported the survey results in three sections.The first section has aggregate numbers on what this sector of the community thinks.The second part has attributed responses from people who wanted to go on the record.And the third has responses from people who wanted to be heard while remaining anonymous.Feel free to cite any or all of this post; we ask only that you link back to provide attribution.We began with seven simple multiple choice questions to get a measure of community sentiment.1.Which of the following digital currencies do you hold?Of the top cryptocurrencies by market cap, the most popular one among influencers is Bitcoin, followed by Ethereum and then ZCash.This seems to bode well for ZCash.2.Do you consider yourself a big-blocker or small-blocker, generally speaking?A plurality of responding influencers were sympathetic to the big-block camp.

However, as we will see in the next section, even most “big-blockers” were not in favor of the Bitcoin Unlimited fork.3.Which of the following applications of digital currency is exciting to you?Most of the major applications of digital currency seem to get people excited.It’s interesting that store-of-value and permissionless payments are still seen as the killer applications by many in the venture-backed community relative to non-currency-based Blockchain applications.This is somewhat at variance with the tone of some media coverage over the last 1–2 years.4.Do you want miners to activate Bitcoin Unlimited?Most do not want activation, but a significant minority of influencers does.5.Do you want Segwit to be activated by miners?The vast majority of respondents want miners to activate Segwit.6.Are you in favor of a non-Segwit-based blocksize increase, via hard fork or otherwise?This option is also quite popular.Many people who support Segwit also support a non-Segwit-based blocksize increase.7.

Can we publish your name with your responses?Most respondents want to stay off the record, which may be due to the contentious nature of the topic.After this point, respondents could choose to give a free response that was either on the record or off the record.Let’s start with the on-the-record responses.Here are the opinions of people who wanted to go on the record.I prepared some slides for Pantera Bitcoin explaining why I don’t support Core and their roadmap.You can view them here: http://docdro.id/NG1sbVqRoger Ver, Early investor in Bitcoin, Blockchain.info, and BitpayAny contentious hard fork would be highly value-negative to Bitcoin.Ben Davenport, Cofounder of BitGoThe Bitcoin community needs an attitude shift if Bitcoin is to continue to be relevant.It’s not just the block-size issue.During this phase of cryptocurrency development, the ability to iterate quickly and add features is important if you want to avoid being overtaken by new altcoins.Right now, Ethereum looks like a far better platform to me.Eli Dourado, Director of Technology Policy at MercatusThe scariest aspect of this whole debate is how fragile the incentives in Bitcoin are when hashpower can so easily be concentrated.Alex Morcos, Bitcoin Core Developer and cofounder of HRT and ChaincodeDon’t fork bitcoin.Ryan Selkis, Managing Director of CoindeskBitcoin needs both on-chain and off-chain scaling if it’s ever to become a mainstream technology.

Off-chain scaling is essentially a transaction volume amplifier; it can only amplify on-chain transactions to a certain extent.As such, in order to maximize the gain from off-chain scaling, larger blocks will be needed so that more second layer solutions can anchor into the blockchain.Jameson Lopp, Software Engineer at BitGoIncreasing the block size would mean that top miners would be incentivized to push the block size even more, to push out some of their competition.Some miners wouldn’t have the computing power, or it wouldn’t be cost efficient for them to process larger and larger blocks, so they would retire.Repeat that process slowly, kicking out a low percentage of miners each time, and you would have taken over Bitcoin.You would own and control it.It’s true that even if that happens, miners couldn’t do certain things — for example they can’t fake a transaction for you.But they could double spend, meaning that the currency is worthless.Luis Cuende, Cofounder at AragonIt’s tough to see the Bitcoin community fight so rabidly.

I personally don’t think any option that increases the risk of miner centralization is a good answer.Kathleen Breitman, Cofounder and CEO of TezosA Bitcoin fork is necessary to unlock the real power and scale of the technology, complex time are ahead, we are talking about the mother of the cryptocurrencies and the birth labor it’s not always easy, but always have a resolution, good or bad, and the life continues.“In the long history of humankind (and animal kind, too) those who learned to collaborate and improvise most effectively have prevailed.”― Charles DarwinJorge Farias, CEO at Cryptobuyer.ioThe fork will probably damage bitcoin’s reputation short term, but I feel that long-term we will learn a great deal from this “fiasco”.In my opinion the “right” chain may not be that one that gains the most following.I am referring to the ETH-ETC split.The morally right chain is classic, while ethereum is more desirable by corporations and investors who feel safer by having the option of their money returned when things go wrong.

Overall, I think a block size increase is the best way forward.Albert Szmigielski, Fintech writer and Blockchain researcherFrom what I’ve read, I do feel SW is the right path forward, but miners need something as well.By expanding (beyond the SW-alone increase) blocks a bit more I think there is room to align both sides.Sean Moss-Pultz, CEO of BitmarkSegwit is the best way to move forward.John Bailon, CEO and Cofounder of sci.phI would like to see a compromise between miners and Core such that the miners are comfortable with the road map.Nick Tomaino, Principal at Runa CapitalThe miners that support Blocksize Unlimited are killing the goose that lays the golden egg for them.They will be the biggest losers as the bitcoin price will crash following such a hard fork.Ranga Krishnan, VP Technology at SkuchainA year ago, we had no implemented mechanism for scalability.Today, we do and it is ready now: segregated witness.This is just the first step in a long line of work to do.But we need to take the first step as well as set a roadmap for future steps.

The time is now.Mike Belshe, CEO of BitGoGiven the contentiousness of the topic, many people wanted to have their voice heard but to speak without attribution.Because there are a lot of them, we’ve flagged a few particularly notable anonymous comments with pull quotes.I see Segwit as the best solution, in the same way that democracy is the best system of government.(Anon 1)The mechanism of Segwit is very important to enable Lightning and services like Rootstock.(Anon 2)The community should replace ideology with common-sense and emotional maturity.(Anon 3)I am not too bothered by technical details of scaling.I simply want to use Bitcoin as I have in the last couple of years.(Anon 4)BU is a complete no go — badly engineered and seems like almost vandalism.However, lightning on segwit still has problems, but the segwit part and all the other fixed part of segwit is really worth a softfork.Seems like a brain against muscles fight (devs against miners) — and I seriously don’t believe we will see a hardfork — rather a very long standoff.

(Anon 5)I don’t think developers should have the power to coerce miners/community into an upgrade via soft fork.There should be both a “dev-market” and a “scaling group”, made from the top minds of every part of the community, which select the best upgrades created by the “dev-market” to apply them to Bitcoin.(Anon 6)I wish Core would simply put a 2mb blocksize increase alongside segwit.If they did this, I think the community would rally around them.(Anon 7)I think that we’re fighting over the wrong hardfork; increasing blocksize by contentious hardfork has obvious drawbacks & will harm the longer term prospect of bitcoin.I would like to see Bitcoin scale, but we should be focusing on fundamental technologies (segwit, lightning, tumblebit, mimblewimble) not parameter tweaking.I think the problem is that people don’t like feeling dumb.Fully understanding the nuances of lightning, tumblebit, and mimblewimble are hard to understand compared to Bitcoin & I don’t think everyone can or will understand it.

Even as a core developer, they give me trouble.One reaction to things you don’t full understand is to respond with fear, and that’s what I think a blocksize increase is.(Anon 8)What doesn’t kill Bitcoin makes it stronger.(Anon 9)From what I’ve read, I do feel SW is the right path forward, but miners need something as well.By expanding (beyond the SW-alone increase) blocks a bit more I think there is room to align both sides.(Anon 10)Segwit is the best way to move forward.(Anon 11)Most people seem to believe that the intransigence of stakeholders in bitcoin, which leads to a less dynamic code base than competitors, is a liability.I think it’s an asset.(Anon 12)This is a political and not really a technical debate.Activating Segwit plus an increase to 2MB block size seems like a straight-forward reasonable compromise to me.(Anon 13)I hope the hard-fork comes sooner rather than later, so that Bitcoin + segwit can move on and scale into the future.(Anon 14)I think that neither segwit nor a BU blocksize increase will gain necessary consensus to be adopted in 2017.

Looking forward to seeing some sort of compromise that will be broadly adopted in 2018 — perhaps segwit+2mb.In any event, the bitcoin disagreements are a gift to the altcoins.If we are at a stalement in both 2017 and 2018, I expect ETH to take over as the #1 store of value in cryptocurrency.(Anon 15)A block size increase is fine, but Bitcoin Unlimited is making too many other unrelated changes.(Anon 16)Bitcoin is not just technology, it is money: a social institution.Like all social institutions (and perhaps as strongly as any other social institution we have) the culture that we create around money will determine whether it lasts.Decentralized digital currencies are a new creation, and we may not always know whether a given precedent’s effects will be beneficial in the long run.But I’m very confident that the the culture represented by BU is antithetical to that of a successful decentralized digital currency.Achieving a “network upgrade” by asking users to abandon the idea that they validate the network’s rules is absurd.In brief, I would never go along with the culture of BU — that’s not Bitcoin to me, even if everyone else in the community did.

I do continue to think that hard-fork block size increases are possible in ways that preserve Bitcoin’s culture, though it remains a challenge to do responsibly, and difficult when we don’t all agree on the culture.(Anon 17)Altcoins are the winners of the Bitcoin Civil War.(Anon 18)I favor bigger blocks, but am against a hard fork and do not trust Bitcoin Unlimited.I wish that Bitcoin Core would make an effort to make amends with the miners in China.Why can’t we have both SegWit and bigger blocks?(Anon 19)Uncertainty is worst than bad decision here.Since we have an example of fork with Ethereum we should move fast.(Anon 20)Slow transaction confirmations are unbearable and have to be fixed as no matter how much we think bitcoin is store of value, fast, hassle free and secure transactions are the key to bitcoins growth.(Anon 21)The two arguing sides should work together to solve this forking issue.(Anon 22).Increasing the block size would mean that top miners would be incentivized to push the block size even more, to push out some of their competition.

But they could double spend, meaning that the currency is worthless.(Anon 23).Bitcoin can be both digital gold and a payment system if the payment aspect is moved to secondary layers above the base protocol such as the Lightning Network, TumbleBit, and sidechains.(Anon 24).If this kind of governance crisis is an existential risk to bitcoin, then bitcoin will fail anyway.Better to err on the side of progress, come what may.(Anon 25)Censorship should not be tolerated.Decisions need to be made as soon as possible or bitcoin will continue to lose significant market share.(Anon 26)Even though I work in this industry, and consider myself technically fairly well-informed, I haven’t succeeded in staying abreast of this debate.The issues involved seem to be too complex for strongly held “quick opinions”.(Anon 27)In my view scaling needs to happen both on- and off-chain for Bitcoin to thrive.Since it has taken so long to do anything I would favor a hard fork to drive the protocol in some direction.

The congestion on the network is real and is affecting people around the world.(Anon 28)We care most about the integrity and security of the network, but one that works to handle the volume required by its users.(Anon 29)It is important to remember that miners do not control Bitcoin.(Anon 30)I do think there are at least two communities here, and that ultimately we will see either a fork or possibly an exodus of the r/btc guys toward Ethereum.(Anon 31)A brief note on representative samplesFrom a technical standpoint, please note that this survey is a snapshot of influencer opinion, not a statistically representative sample from (say) the entire population of Bitcoin holders or Bitcoin miners.We may permit such a survey in the future, but (a) creating a sampling frame for the population of Bitcoin holders is nontrivial given the size, anonymity, and international nature of the community and (b) it’s not obvious that such a survey would even be useful in determining what is going to happen next with the hard fork, as the Bitcoin protocol is not governed by proof-of-stake.As such, we still believe this survey is a useful snapshot because it is reflective of what many people at venture-backed companies are thinking about the current controversy.