bitcoin fiat chart

- waiting for first trade... - - https://file.army - Each trade results in a bitcoin being sent from the currency counter in red to the country on the map.The current value in bitcoin is listed in green and plotted across the map.The last exchange rate for each currency is listed in @purple and updated for each trade.Data from BITSTAMP, BTCChina, BTC-E, Bit2c, Mercado Bitcoin BR, Local Bitcoins, OKCoin, BTCTrade, Huobi China, bitx.co.za, Cavirtex, Bitfinex, GeminiExchange volume distribution Based on the last 30 days.by market by currencyToday, we live an exciting era when financial technology could upend a long-standing regime that has had total control of consumer money.Digital currencies such as bitcoin and the burgeoning number of altcoins allow tech-savvy people the ability to better bank themselves.At the same time, the industry's consumer services and nascent startups are beginning to bring social elements into the ecosystem in effort to appeal to mainstream consumers.

This work is raising awareness of the fact that there is now a viable alternative to government-backed money, not to mention the problems inherent to the existing global financial system.What is most frustrating about banking today is the process that must be endured to move money.This is experienced by both consumers and businesses alike.However, it is the procedure behind the scenes that might be the biggest albatross of all.What has been beneficial for the global banking system is that it has been able to easily conceal its byzantine systems from the public.A bitcoin transaction from one party to another, anywhere in the world, might look something like this: However, with fiat money, things aren't so simple.Sending money globally from one party to another is massively complex.Any party sending money to another one internationally, for example, has to go through a lot of hoops.That procedure often can look something like this: In exchange for dealing with overly complex procedures, banking customers are paying the price.

They do so in the form of exorbitant fees, and many of these fees are mandatory for consumers who want to have an account and store money with a financial company.USA Today recently reported that 30-35% of people 18-34 years old would bank with a technology company.It's no mystery why.That demographic's view is that technology companies are able to solve real problems.The simplification of banking and complicated fee schemes is something many clearly feel is possible with technical innovation.

mine litecoin macThe procedure for moving money from one country to another, as the chart shows above, is messy.

bitcoin valuta sekEven a Federal Reserve economist has said that banks will have to "adapt or die" in the face of technical innovation.

bitcoin mining app ubuntuA huge problem continues to exist for users of digital currency, whereby converting fiat into bitcoin is still not very easy.

When sending USD to a country that accepts only another form of currency as payment, there are a ton of banking hoops to jump through.It requires fiat conversions through financial procedure.It is why many banks today are making it difficult to be involved with bitcoin.Should bitcoin become global, the concern from these institutions is they will be left out.Transforming cryptocurrencies from being a store of value to a useful accounting measurement will help this tremendously.If that were to happen, the need for exchanging bitcoin into fiat for regular purchasing will be reduced.There is major upside for bitcoin if the industry itself can get past some of the major issues that exist today.Regulation, access, and thus adoption, are some of the major hurdles.This will take time to work itself out.Banks, though, have a lot of time and effort to put in as well.These organizations must appease a new generation that will demand more from them.In exchange for the storage of money in a bank, customers and businesses should be expecting more – and digital currencies will force this issue.

Contact us at [email protected]/* */.Bitcoin was created in 2009 by a mysterious character who claimed it to be a payments network.But unlike most other payment networks like PayPal and Visa, it screwed with our minds by having its own token.A token that had a price that floated against other currencies.In basic terms, this means if you fund a bitcoin wallet to buy something, it may be worth less (or more) by the time you come around to spending it.This is the story of bitcoin volatility, we’ll be studying its personality over its short and notorious history.

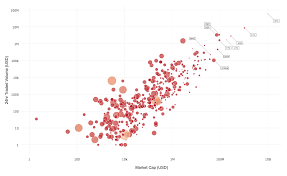

It was partly inspired by Vinny Lingham who calculated Bitcoin will achieve the necessary price stability to be a store of value at $3000 per coin (~$50b market cap), and estimated that to be two year away.We shall see if the data backs this up.@VinnyLingham interview: #bitcoin mainstream in 3-10yrs.Useful as a store of value when price hits $3k ~2yrs away https://t.co/0qmQTGU1Cb — Willy Woo (@dangermouse117) August 12, 2016 We’ll start this journey with a bit of eye candy.Let me plot for you the volatility of 600 cryptocurrencies against their market caps and 24 hour traded volume (i.e.Volatility is represented by the size of their circle.Okay circles, I want you to be small and towards the top, got it?(This equals low volatility and high liquidity).As it turns out it was a weak correlation between market cap and volatility.Apart from looking real nice, it showed just how far ahead bitcoin is over the other coins.Pundits should know I used log scales and exponentially scaled circles to reduce the exaggerated differences here.

Bitcoin’s volatility over time Onwards to the real focus of this study… Dearest Bitcoin, how long will it take for you to be as stable as fiat currencies?To answer this, I collated 5 years of bitcoin price data against USD (BTCUSD) and compared it to EURUSD and NZDUSD currency pairs to produce this very telling graph.[Live Chart] First some details about this graph: Circles are proportional to bitcoin’s 24 hour traded volume, I wanted a visual representation of bitcoin’s growth as a traded currency I chose EURUSD volatility as these two are the ballers in the room with M1 money supplies of 7.5 and 3.3 trillion respectively.The big guys should be the most stable NZDUSD volatility is the small guy in the room, it exhibits the highest volatility of the commonly traded FOREX pairs Trendlines have been calculated using exponential regression analysis (i.e.it was done with numbers, I just didn’t eyeball it) 60-day volatility are used in these plots.

What we are seeing is bitcoin’s peak volatility is reducing steadily and will enter the realms of fiat currency (below 5.5%) by around July 2019.I found this surprising.For a currency with a tiny market cap of $10b, compared to say the Euro’s M1 money supply of $7.5t, bitcoin’s price stability is ridiculously good.Investor conclusions The economic properties needed for bitcoin to go mainstream are developing quickly.If we take fiat-level FOREX volatility as a level in which the public find acceptable (this is not necessarily true), we are less than 2 years out for the start of prime time “bitcoin as payments” heaven.For now these are my investor related conclusions: Price stability gives Bitcoin even more bullishness Price stability is needed before we get consumers buying and holding bitcoins for short and medium term spending.When this happens, it’ll have a large and positive impact on price.The next 2 years of bitcoin will be bullish in this regard.Buying and holding bitcoin for native payments has a very different economic fingerprint than say via bitcoin as remittances, where the receiver of funds immediately sells to move back to fiat currency which is more stable.

Remittances use bitcoin as a pass through token, or in other words it’s price neutral as remittance adoption increases.Payment ventures/projects are too early Ventures that focus on bitcoin as a form of payment are premature – examples include payment gateways like BitPay and cryptocurrency point-of-sales ventures Plutus and BlockPay.We are probably at least 2 years out from the necessary price volatility necessary for this sector to be ready.For now bitcoin HODLers are speculative investors.If I was a venture capitalist or an alt-coin ICO investor, I’d be steering clear for a couple more years.Keep away from alternative payment coins Given bitcoin has by far the largest network effects and an exponential head start on stability and liquidity, I would say any other payment alt-coin is going to have a hard time competing, especially in 2 years and we get a critical mass of sorts on the bitcoin network.Examples include the privacy coins and payment coins like ZCash, Monero, Dash, and other less known coins too many to list.