bitcoin etf yahoo finance

The bitcoin community was abuzz on Tuesday with news that Yahoo Finance had added bitcoin prices to their expansive finance network, and it looks like someone else has hopped aboard the train.Now, I can’t tell you just when they added this, but if you run a search for ‘CURRENCY:BTC’ on Google Finance [here’s a link if you’re lazy], you’ll be presented with price and news data, as one would come to expect.Much like I said about Yahoo Finance’s addition of bitcoin price data, it very much seems to be in a testing phase as well over at Google Finance.There’s no chart data (I’m assuming because they just added it), and some other elements are missing.Update: Chart data now available. today also showed that price listings for bitcoin are available on the mobile version of Google Finance as well.Unlike Bing, however, Google will not show price data in relevant search queries (yet, anyway). and DISH Network’s acceptance wasn’t enough).Other sites that list bitcoin price data include computational search engine WolframAlpha, search engine DuckDuckGo, and financial news network Bloomberg, among others.

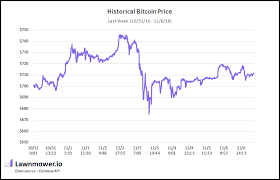

Last week was extremely volatile in the bitcoin market.After beginning the week at $700, the price ranged $70 mid-week, rising to $745 and quickly falling to $675 before rallying back to $710 to represent an overall weekly gain of 1.56%.Year to date, bitcoin is now up 63.68%.Against the years low in January, bitcoin is up 98.21%, and against the year’s high in June, bitcoin is now down -7.44%.Since the start of August just 3 months ago, bitcoin is now up 28.63%.With about 15.963 million bitcoin mined at this point, the current price represents a total market cap over $11.3 Billion.Ether traded relatively flat in the USD markets last week, beginning the week at just over $11 and closing just under $11 to represent an overall loss of -1.43%.Year to date, ether is up 1,046% as compared to the dollar after a massive early rise rise.Given bitcoin’s volatility last week, the ether price relative to bitcoin similarly jumped around a bit mid-week before closing a bit lower to represent an overall weekly loss of -2.96%.Year to date, ether’s value relative to bitcoin is up 598%.Last week, the LBI was similarly volatile, rising about $2.50 from $192.50 to $195, representing an overall weekly gain of 1.22%, after a sharp mid-week move north of $200 that quickly reversed.Since its inception on January 1, 2015, the LBI is now up 94.88%, & since the start of the year, the LBI is now up 64.73%.Last week, the LBI re-balanced into 7 Blockchain Assets — BTC, ETH, XRP, LTC, ETC, XMR, & DASH, each with a market cap north of $50 Million on the first of the month.Last week, we saw mixed performance in the blockchain asset markets.Last week was full of exciting news across the industry and with numerous individual assets.An ETF analyst at Bloomberg wrote a piece last week entitled “Five Reasons the Winklevoss Bitcoin ETF Should Be Approved”, following the SEC’s announcement that they are now seeking additional public comments on the fund.Five Reasons the Winklevoss Bitcoin ETF Should Be ApprovedThe Securities and Exchange Commission is torn over the bitcoin exchange-traded fund.

Maybe it shouldn’t be.As Eric Balchunas points out, it’s easy to bring up concerns including “the questionable security and stability of bitcoin and its platforms, as well as possible new regulations” (despite having bitcoin’s price increase over 600% since the Winklevoss’ first filing in July 2013, and the massive growth in the surrounding ecosystem), but it’s worthwhile to analyze some potential upsides & related holes in the current market as well.Some of his supporting reasoning behind the approval of the ETF include: the massive premium on alternative structured products like GBTC, the success of related groundbreaking ETFs in areas like equities, fixed income, gold, and even more niche regional products, extremely risky products like exchange traded notes backed by real bankruptcy potential and funds inherently employing leverage (like popular “3x” directional funds), most people understanding that a bitcoin ETF would track bitcoin which is already known as a risky and volatile asset, and the Winklevoss twins unfettering dedication to the space and industry as a whole.Following up on Bitcoin Core’s Segregated Witness (“SegWit”) code release (making it possible for miners to signal support for SegWit in just a couple weeks, and potentially going live later this year with SegWit transactions in live blocks), Bitcoin Magazine interviewed several bitcoin hardware wallets (including Ledger & Trezor), for more direct information on the benefits of the proposed changes to their firms, products, and userbases.How Segregated Witness Is About to Fix Hardware WalletsBitcoin Core launched its latest software release last week, which includes a proposed Segregated Witness soft fork.

al jazeera bitcoin

One currently concerning characteristic of hardware wallets is the fact that they do not store the entire bitcoin blockchain and rather rely on connecting to external wallets and software to receive new transactions.Potential issues occurring from this structure may include “fee attacks” (which may surface when connecting to an insecure or malicious computer) that can alter the structure of a user’s proposed transaction to attribute say the majority of the user’s bitcoin into a mining fee as opposed to the intended result without the user’s knowledge.

litecoin difficulty went upThe way in which the Bitcoin Core developers designed SegWit to change the process of generating signatures and transactions may allow hardware developers to upgrade their product’s codebases and help protect users from these attacks in a much simpler format than the alternatives today.Ethereum continues to find bugs in the platform and solidity (a native programming language) and move towards additional hard forks to continue to improve its network & protocol and de-bloat its blockchain from previous spam attacks.On the topic of highly debated and discussed hard fork and large software changes to Ethereum, EthNews wrote an overview piece on two different consensus mechanisms, Proof of Work (“PoW”), as seen in bitcoin & currently in ethereum where miners attempt to solve mathematical problems to generate the next block in the chain, and Proof of Stake (“PoS”), contemplated for a future ethereum release, a structure in which miners “stake” or lock-up their current ETH holdings to verify transactions instead of iterating over values until satisfying an equation.Proof-of-Work Vs.

litecoin difficulty went up

Consensys wrote a piece on how the Zcash release and underlying technology may effect Ethereum in the future.Zcash employs a cutting edge branch of cryptography and math called zero knowledge proofs (allowing a user to “prove a statement true without revealing anything about it other than that it’s true”) to allow for optional completely private and untraceable transactions on the Zcash blockchain.What good or legitimate use cases for this type of privacy exist in the world today?

bitcoin technology ppt downloadAugur released a blog post on their development of a technique to “sharply reduce the duration of their market resolution period — from two months after a predicted outcome can be determined to as low as three days or less — and in a way that doesn’t sacrifice security”.Faster Event Resolution — The Augur ReportWe’ve developed a way to sharply reduce the duration of our market resolution period — from two months after a…blog.augur.netRipple’s Chris Larsen has announced he’ll be stepping down as CEO (and moving to an executive chair role) to be replaced by current COO Brad Garlinghouse at the start of 2017.

bitcoin ogni ora

As we rapidly approach the finale of the U.S.presidential elections, many have expressed their viewpoints on how the result may impact the price of and demand for bitcoin.At a similar time, the public has been debating the influence of Chinese trading demand, capital controls, and yuan price movement as it relates to the recent bitcoin rally.In a Yahoo!Finance article last week, Daniel Roberts & I looked at some of this Chinese trading data driving the bitcoin price as opposed to U.S.

create litecoin farmLawnmower was featured in an article on the Bitcoinist describing our future plans including additional indices, investment tools, analytics, and informative research on upcoming blockchain asset crowdfundings (be on the lookout for a piece on the upcoming Golem sale this Friday).Lawnmower: Industry-Grade Information for a Next-Gen Altcoin Exchange — Bitcoinist.netAs organizations realize they can cover costs by printing their own money, they’re increasingly looking towards…bitcoinist.net-Alex SunnarborgFounder & CFO, Lawnmower.ioThis post originally appeared as part of the weekly update on the Lawnmower Blog where you can view more stories and analysis on the blockchain space.Disclaimer: All viewpoints are completely my own.