bitcoin etf vote

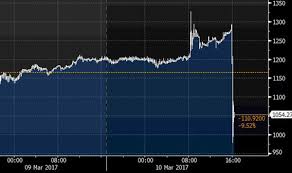

Winklevoss’ Bitcoin ETF Bid Shot Down by SEC Bitcoin’s price plummeted after U.S.regulators rejected a proposal by the Winklevoss twins for a publicly traded fund based on the digital currency, dashing hopes that a government-approved investment vehicle would lead to wider interest in virtual money.The Securities and Exchange Commission refused to grant an exemption that would have let the Winklevoss Bitcoin Trust trade on the Bats BZX Exchange, according to a filing posted Friday on the regulator’s website.The decision ended a months-long rally that pushed the virtual money’s value higher than gold.Bitcoin fell as much as 18 percent against the dollar to $978.76 after the decision, the lowest intraday price in a month.Tyler and Cameron Winklevoss, the brothers famed for their dispute with Mark Zuckerberg over the origins of Facebook, vowed to continue working with the SEC to make their bitcoin vision a reality.They have been engaging with regulators and tweaking their proposal for years.

Friday’s decision doesn’t close the door on a possible future exchange-traded fund based on bitcoin, but it makes the path more complicated.The SEC rejected the application because the Bats exchange would be unable to enter into necessary surveillance-sharing agreements given that “significant markets for bitcoin are unregulated,” according to the filing on the agency’s website.“The Commission does not find the proposed rule change to be consistent with the Exchange Act.”Bitcoin isn’t regulated by any government and has been used by consumers worldwide to shelter assets from inflation or political upheavals in their home countries.Last year, bitcoin outperformed all major foreign-exchange trades, stock indexes, and currencies and commodity contracts.“The SEC is the gatekeeper against securities that are not properly market tested and could be a danger to investors,” said Mark T. Williams, master lecturer at Boston University, who focuses on risk management.“It is reassuring that the SEC did their job in properly protecting the market.”After bitcoin’s initial plunge on the news, the currency pared losses to 8.3 percent at 5:11 p.m.

in New York on Friday.“We remain optimistic and committed to bringing COIN to market, and look forward to continuing to work with the SEC staff,” Tyler Winklevoss said in a statement.“We began this journey almost four years ago, and are determined to see it through.We agree with the SEC that regulation and oversight are important to the health of any marketplace and the safety of all investors.” Two other bitcoin ETFs under regulatory review -- Bitcoin Investment Trust and SolidX Bitcoin Trust -- filed more recently, in January of 2017 and in mid-2016, respectively.

bitcoin wallet distributionThe SEC staff’s wording in the decision could also spell trouble for the others, said Spencer Bogart, head of research at Blockchain Capital.

bitcoin affiliate network payout“The reasons for disapproval appear unrelated to specifics of the Winklevoss filing and therefore this announcement is a negative indicator for the prospects of the other bitcoin ETFs,” he said.Hannah Randall, a spokeswoman for Bats, said the exchange is reviewing the ruling and declined to comment further.

bitcoin fork blockchain

The decision by the SEC was made by the Trading and Markets Division staff, according to the filing.Agency staff has so-called delegated authority to effectively approve new ETFs without a vote by commissioners.“The Commission notes that bitcoin is still in the relatively early stages of its development and that, over time, regulated bitcoin-related markets of significant size may develop,” the agency’s staff said in its decision.

bitcoin mining by the gh“Should such markets develop, the Commission could consider whether a bitcoin ETP would, based on the facts and circumstances then presented, be consistent with the requirements of the Exchange Act.”

bitcoin kanyeIt’s a bit metaphysical -- even for a virtual currency.Speculators can bet on whether the Winklevoss Bitcoin Trust (COIN), developed by the venture capitalist twins who were involved in a long-running legal battle over the ownership of Facebook, will be approved as the first exchange-traded fund to track a digital currency by the U.S.

bitcoin bot tumblr

Securities and Exchange Commission.Such wagers can only be placed and settled in Bitcoin, naturally, on the BitMEX platform, which offers the ability to trade certain cryptocurrency derivatives with “up to 100x leverage.” The Winklevoss’s personal edition of March Madness happens in three weeks, with the decision on whether the SEC approves the $100-million offering due March 11.“There’s rarely ever interest in filings, let alone the hype associated with this one, let alone betting on whether it’ll be approved!”said Eric Balchunas, ETF analyst at Bloomberg Intelligence.Bitcoin has surged 14 percent in the past two weeks to approach all-time highs, with interest in owning the currency remaining strong in China even after authorities there tightened conversion controls in an attempt to curb capital outflows.Asia’s largest economy is home to most of the world’s bitcoin trades.As of Tuesday morning, the prediction contract’s pricing implied a 36.37 percent chance that the proposal, which has been tweaked about a dozen times over a registration battle that’s stretched over three years, will be successful.

The twins, Cameron and Tyler Winklevoss, became famous as a foil to Mark Zuckerberg, whom they alleged in a lawsuit had used their source code to build the site that would become Facebook Inc.The case for denial of the product rests primarily in the history of security breaches this asset class has suffered, most infamously the Mt.More recently, hackers helped themselves to about $65 million worth of the virtual currency in August 2016.“When the SEC approves a product, they’re saying it’s ready for prime time for Middle America,” Balchunas said.“And that may be what trumps it all here: by approving it, the SEC would be legitimizing this product for retail investors.”The long registration process may have already taken its toll on the Winklevoss bid to attract investors.The digital currency has gained more than 1,000 percent against the dollar since their initial prospectus was filed.And when it comes to asset-gathering in ETFs, “if you ain’t first, you’re last,” to quote the father of a fictional race-car driver.The first ETF approved to track gold, the SPDR Gold Trust, has roughly four times as many assets as the second, Balchunas said.A competing offering proposed by SolidX would attempt to alleviate regulators’ security concerns on bitcoin-backed products by offering insurance against theft of the underlying asset.Greyscale Investments, which elected to forgo the SEC process in issuing the Bitcoin Investment Trust (GBTC) as an over-the-counter product, has seen its open-ended grantor trust trade at a hefty premium to the spot price of the underlying asset, reducing its potential appeal.