bitcoin etf announcement

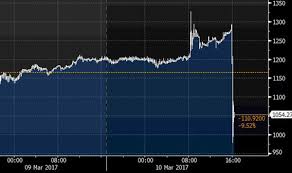

Winklevoss’ Bitcoin ETF Bid Shot Down by SEC Bitcoin’s price plummeted after U.S.regulators rejected a proposal by the Winklevoss twins for a publicly traded fund based on the digital currency, dashing hopes that a government-approved investment vehicle would lead to wider interest in virtual money.The Securities and Exchange Commission refused to grant an exemption that would have let the Winklevoss Bitcoin Trust trade on the Bats BZX Exchange, according to a filing posted Friday on the regulator’s website.The decision ended a months-long rally that pushed the virtual money’s value higher than gold.Bitcoin fell as much as 18 percent against the dollar to $978.76 after the decision, the lowest intraday price in a month.Tyler and Cameron Winklevoss, the brothers famed for their dispute with Mark Zuckerberg over the origins of Facebook, vowed to continue working with the SEC to make their bitcoin vision a reality.They have been engaging with regulators and tweaking their proposal for years.

Friday’s decision doesn’t close the door on a possible future exchange-traded fund based on bitcoin, but it makes the path more complicated.The SEC rejected the application because the Bats exchange would be unable to enter into necessary surveillance-sharing agreements given that “significant markets for bitcoin are unregulated,” according to the filing on the agency’s website.“The Commission does not find the proposed rule change to be consistent with the Exchange Act.”Bitcoin isn’t regulated by any government and has been used by consumers worldwide to shelter assets from inflation or political upheavals in their home countries.

bitcoin bot gratisLast year, bitcoin outperformed all major foreign-exchange trades, stock indexes, and currencies and commodity contracts.“The SEC is the gatekeeper against securities that are not properly market tested and could be a danger to investors,” said Mark T. Williams, master lecturer at Boston University, who focuses on risk management.

bitcoin virus source code

“It is reassuring that the SEC did their job in properly protecting the market.”After bitcoin’s initial plunge on the news, the currency pared losses to 8.3 percent at 5:11 p.m.in New York on Friday.“We remain optimistic and committed to bringing COIN to market, and look forward to continuing to work with the SEC staff,” Tyler Winklevoss said in a statement.“We began this journey almost four years ago, and are determined to see it through.

visa to litecoinWe agree with the SEC that regulation and oversight are important to the health of any marketplace and the safety of all investors.” Two other bitcoin ETFs under regulatory review -- Bitcoin Investment Trust and SolidX Bitcoin Trust -- filed more recently, in January of 2017 and in mid-2016, respectively.

como gerar um bitcoinThe SEC staff’s wording in the decision could also spell trouble for the others, said Spencer Bogart, head of research at Blockchain Capital.

bitcoin chrome bot

“The reasons for disapproval appear unrelated to specifics of the Winklevoss filing and therefore this announcement is a negative indicator for the prospects of the other bitcoin ETFs,” he said.Hannah Randall, a spokeswoman for Bats, said the exchange is reviewing the ruling and declined to comment further.The decision by the SEC was made by the Trading and Markets Division staff, according to the filing.

bitcoin halalAgency staff has so-called delegated authority to effectively approve new ETFs without a vote by commissioners.“The Commission notes that bitcoin is still in the relatively early stages of its development and that, over time, regulated bitcoin-related markets of significant size may develop,” the agency’s staff said in its decision.

buy bitcoins rbc“Should such markets develop, the Commission could consider whether a bitcoin ETP would, based on the facts and circumstances then presented, be consistent with the requirements of the Exchange Act.”

buy bitcoin without gst

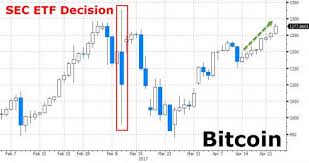

Get email alerts Final rule on proposed bitcoin ETF to come in March The multiyear campaign for a bitcoin ETF will end in March Digital currency is in its ascendancy.If you’re excited about the idea of investing in a bitcoin-tracking exchange-traded fund, you’ll have to wait a bit longer to learn if you can—again.The Securities and Exchange Commission on Wednesday designated March 11 as the date by which it would either approve or disapprove the Winklevoss Bitcoin Trust ETF, which would be the first to exclusively track the digital currency.

ethereum coin stockA decision would represent the end of a multiyear campaign to bring a bitcoin ETF to market.Tyler and Cameron Winklevoss, who run Winklevoss Capital, first announced plans for one in 2013; the pair also run both WinkDex, a bitcoin price index, and Gemini, a bitcoin custodian and exchange.Winklevoss Capital didn’t immediately return requests for a comment.

The SEC has delayed issuing a ruling on the proposed ETF multiple times.In October, it declined to rule, saying it was instead seeking additional public feedback on the proposal.In a filing published on Wednesday, the SEC said it had subsequently received 30 comments.Read: Here’s one easy way to get exposure to bitcoin ahead of the Winklevoss ETF The proposed fund, which would trade on the Bats exchange, was first published for public comment on July 14 of last year.The SEC could have ruled on it on Jan.10—180 days after that date—but it is instead waiting until March 11, which is 240 days since July 14.“The Commission finds it appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider this proposed rule change,” the SEC wrote in a statement.Because March 11 is a Saturday, the ruling could actually be announced on Friday, March 10, the final business day before the deadline.

While investors can put their money into bitcoin directly, those waiting on an ETF to get bitcoin exposure have missed out on some massive gains.The price of a single coin more than doubled in 2016, due to increasing adoption of bitcoin among professional investors, improving market fundamentals and a perception that the world’s largest economies are growing increasingly unstable.See also: Bitcoin rally boosts rival digital currencies 30 yr fixed Jumbo 30 yr fixed 15 yr fixed 10 yr fixed 30 yr fixed refi 15 yr fixed refi 5/1 ARM 5/1 ARM refi $30K HELOC $50K HELOC $75K HELOC $100K HELOC $30K Home Equity Loan $50K Home Equity Loan $75K Home Equity Loan $100K Home Equity Loan 5 yr CD 2 yr CD 1 yr CD MMA $10K+ MMA $50K+ MMA Savings MMA Savings Jumbo 60 Mo Used Car 48 Mo Used Car 36 Mo Used Car 72 Mo New Car 60 Mo New Car 48 Mo New Car 60 Mo Auto Refi 36 Mo Auto Refi Avg.