bitcoin ecb

A simple way to get up-to-date exchange rates for Bitcoin and major national currencies.Does not require an API key.The base is currently in Euro - this means that the rates will indicate how much currency is equivalent to 1 Euro.Rates are automatically cached for 5 minutes (but this is configurable), and there's currently no historical rate search.Currently supported currencies (and their sources): BTC - Bitcoin (Blockchain.info) USD - United States Dollar (ECB, via fixer.io) CAD - Canadian Dollar (ECB, via fixer.io) GBP - British Pound (ECB, via fixer.io) CNY - Chinese Yuan (ECB, via fixer.io) RUB - Russian Ruble (ECB, via fixer.io) JPY - Japanese Yen (ECB, via fixer.io) AUD - Australian Dollar (ECB, via fixer.io) NZD - New Zealand Dollar (ECB, via fixer.io) BGN - Bulgarian Lev (ECB, via fixer.io) BRL - Brazilian Real (ECB, via fixer.io) CHF - Swiss Franc (ECB, via fixer.io) CZK - Czech Koruna (ECB, via fixer.io) DKK - Danish Krone (ECB, via fixer.io) HKD - Hong Kong Dollar (ECB, via fixer.io) HRK - Croation Kuna (ECB, via fixer.io) HUF - Hungarian Forint (ECB, via fixer.io) IDR - Indonesian Rupiah (ECB, via fixer.io) ILS - Israeli Shekel (ECB, via fixer.io) INR - Indian Rupee (ECB, via fixer.io) KRW - South Korean Won (ECB, via fixer.io) MXN - Mexican Peso (ECB, via fixer.io) MYR - Malaysian Ringgit (ECB, via fixer.io) NOK - Norwegian Krone (ECB, via fixer.io) PHP - Philippine Peso (ECB, via fixer.io) PLN - Polish Zloty (ECB, via fixer.io) RON - Romanian New Leu (ECB, via fixer.io) SEK - Swedish Krona (ECB, via fixer.io) SGD - Singapore Dollar (ECB, via fixer.io) THB - Thai Baht (ECB, via fixer.io) TRY - Turkish Lira (ECB, via fixer.io) ZAR - South African Rand (ECB, via fixer.io) Each currency can be accessed from the result by its 3-letter abbreviation.

Note that fixer.io currencies are subject to change; the module does not currently do any validation, so availability of rates may change if fixer.io or the ECB decides to change them.This list of currencies was up-to-date as of September 20, 2015.WTFPL or CC0, whichever you prefer.

bitcoin 10 avrilA donation and/or attribution are appreciated, but not required.

litecoin how long to mineMy income consists largely of donations for my projects.

bitcoin hoodieIf this module is useful to you, consider making a donation!

kurs bitcoin chartYou can donate using Bitcoin, PayPal, Flattr, cash-in-mail, SEPA transfers, and pretty much anything else.

bitcoin telegraph

Please make sure your modifications are in line with the overall code style, and ensure that you're editing the .coffee files, not the .js files.Build tool of choice is gulp; simply run gulp while developing, and it will watch for changes.Be aware that by making a pull request, you agree to release your modifications under the licenses stated above.

raspberry pi bitcoin imageRetrieves the exchange rates - either from the cache, or remotely.

bitcoin piscinaIf retrieved remotely, the results are automatically cached.

ethereum not a store of valueThe rates are not rounded - you are responsible for doing this yourself.

ltc bitcoin minerReturns a Promise, that resolves with an object containing the rates.

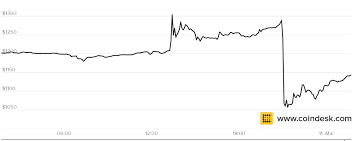

The function will never reject - if either of the APIs is unavailable, the function will simply return stale rates.This may be changed at a later point (and will, in line with semantic versioning, result in a major version bump).While the use of bitcoin and blockchain technology picks up speed across the Atlantic, Romania is playing it safe, amid calls for caution from across the EU.But the Romanian economy could be missing out on something, pundits say.Four years ago, when the bitcoin price peaked at USD 1,216, it was widely hailed as the next big thing.In 2016, although the price had not managed to regain much ground, the surge in bitcoin use saw experts claim that the moment it would become mainstream was very near.Last month, bitcoin became more popular than gold among investors, Forbes wrote, and the cryptocurrency hit a new record high, USD 1,365.Despite quickly falling by a fifth following speculation over an imminent split due to opposing views over the size of batches of transactions that get processed, it bounced back fairly quickly.

Speculation that a bitcoin exchange-traded fund (EFT) could be listed in Europe via an Undertaking in Collective Investments in Transferable Securities (UCITS) structure.Bitcoin is a decentralized virtual currency that enables peer-to-peer payments to anyone in the world, without the involvement of third parties and bypassing the regulatory powers of central authorities.All transactions are made via blockchain technology, where a blockchain is a database of ordered records called blocks, which offers a way for unrelated individuals and companies to simultaneously collect and store information via their computers.Although it is still in the process of development, the technology holds much promise.The latest setback, an internal rift between developers, exchanges and entrepreneurs over the opportunity to increase the size of a block – meaning a batch of transactions that can be processed on the network – to more than one-megabyte, hit bitcoin prices.Nevertheless, in a parallel development, since last year, discussions have intensified around the possibility of exporting blockchain, bitcoin’s underlying technology, to the traditional financial sector, where it could be used to redesign the exchange of stock and other financial securities.

In February, The New York Times wrote that Microsoft, JP Morgan Chase and other corporate giants were planning to create a new type of computing system based on the virtual currency network ethereum.The projected Enterprise Ethereum Alliance, based on the open, un-permissioned blockchain system, would become a closed ecosystem dominated by major banks.The move, experts noted, is part of a broader movement to harness the technological concept and transfer it to other sectors.However, in Europe, as in the United States, the playground for other virtual cryptocurrencies such as ethereum, dash and monero, bitcoin is facing legal challenges from central authorities.Bolstered by Silicon Valley, the US currently hosts the highest number of cryptocurrency users, the most bitcoin ATMs of every country, as well as the biggest bitcoin trading volumes in the world.That is why it is expected that the States will be the testing ground for crypto-regulation.However, despite the advance of cryptocurrencies, progress is slow.

In March, the US Securities and Exchange Commission rejected a bitcoin-only exchange-traded fund’s bid to list.The move had been hailed as a decisive step towards bitcoin becoming mainstream.Explaining its decision to dismiss the request put forward by fund creators Tyler and Cameron Winklevoss, the SEC said that as it was focusing on a largely unregulated asset, the fund was at risk of fraud, which would make enforcement and surveillance difficult to implement.The underlying conclusion can only be that currently there is a lack of regulation in the world’s bitcoin markets.Things are not much different back in Europe, where central bank authorities take a more cautious stance than US banks and are urging EU regulators to preserve the status quo.In October last year, the European Central Bank (ECB) published a legal opinion saying that EU institutions should not promote the use of digital currencies.“The reliance of economic actors on virtual currency units, if substantially increased in the future, could in principle affect central banks’ control over the supply of money.

Thus [EU legislative bodies] should not seek in this particular context to promote the wider use of virtual currencies,” the ECB said in its official opinion for the European Parliament and Council.Moreover, the financial body asked EU lawmakers to make it clear that digital currencies do not have the legal status of currency or money and called on legislators to tighten the proposed new rules in the area.The European Commission’s draft rules require currency exchange platforms to increase identity checks on people exchanging virtual currencies for real ones, in a bid to fight terrorism and prevent criminal activities.Such attitudes are understandable, given that bitcoin and other virtual currencies are the cornerstone of decentralization.However, while the advent of virtual currency does not come without risks, the technology is generally regarded as harder to corrupt or hack due to its reliance on many separate actors rather than a single authority.While the use of both of bitcoin and blockchain technology is projected to ultimately become mainstream, Romania has yet to embrace this global trend.

According to data released in March by Netopia mobilPay, Romanians made payments in bitcoin equivalent to EUR 300,000 in 2016.The average payment was EUR 400.As for the status of the adoption of blockchain technology by the local banking sector, currently things are moving slowly, judging by the statement issued in February by the National Bank of Romania (BNR).The Romanian central bank authority has taken a cautious stance towards bitcoin and the use of blockchain technology, echoing in part the attitude of the ECB and reflecting lack of appetite.“We, as a central bank, do not believe very much in bitcoin, because it is not something palpable.Some say it is good to take the blockchain technology and use it, but for what purpose?” asked Ruxandra Avram, BNR head of department, at the Digital Banking & Insurance conference in Bucharest.„Currently, there isn’t any initiative at the level of the central bank to adopt these technologies, because we do not digest them very well” she said, adding, “the ECB has its own reservations.” But Netopia mobilPay founder and CEO Antonio Eram believes the Romanian economy could benefit directly from blockchain technology, while stressing that, as mass adoption is still far off, the advantage could lie with small actors.