bitcoin difficulty news

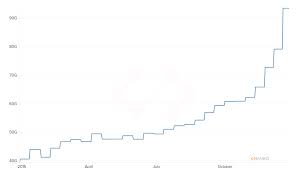

The Bitcoin network’s mining difficulty level has increased by over 10%.The change happened on November 18, 2016, as a part of the digital currency network’s inbuilt regulation mechanism.The Bitcoin difficulty level ensures constant block generation times irrespective of the total hashing power.The increase in difficulty levels from the previous 254,620,187,304 to the new 281,800,917,193 follows an increase in the Bitcoin network’s total hash rate from 1,822,642,296 GH/s to 2,017,209,539 GH/s.The change in Bitcoin network difficulty now stands at 10.68%.This is the first time, the Bitcoin difficulty level has seen a double-digit percentage increase since February, 19 of this year.For those who are a bit confused, the Bitcoin network difficulty is a metric signifying the increasing complexity of the SHA256 algorithm in comparison to its simplest form.The difficulty levels also signify the amount of processing power required to decipher the encryption to discover new blocks on the Bitcoin network.

The difficulty levels are constantly recalculated and adjusted at every 2016 block interval.The expansion of mining operations and increasing processing power of the mining hardware are the main reasons behind the increasing difficulty levels.The recent surge in difficulty levels can be due to the expansion of few Bitcoin mining pools across the world.With few more data centers set to go live in the coming months, we can expect the difficulty level to rise further.According to the information available on one of the cryptocurrency websites, the next estimated Bitcoin difficulty level is 304,441,129,592 — which is about 8.03% more than the current level.The new exchange is expected to happen within the next twelve days.The Bitcoin network witnesses the highest increase in the difficulty level in the beginning of this year after it surged over 20 percent on February 7.As the technology behind the development of ASICs and other specialized hardware continues to improve, the difficulty levels have only one way to go, and that’s upwards.

Things continue to heat up in the Bitcoin mining world as of late.As the hashrate continues to increase, it is only to be expected the mining difficulty continues to go up accordingly.Earlier this morning, the difficulty adjusted once again and increased by 7.43%.This adjustment marks a new all-time high for mining ever since bitcoin was created.New hardware seems to be coming online at an accelerated pace, which is nice to see.One always has to wonder who is online these days.The obvious choice would be hardware manufacturers, although that is not necessarily a given.Considering how the correlation between different mining pools has not changed overnight, it is difficult to determine where the hashrate is pointing at.Antpool and F2Pool remain the two largest pools, followed by BitFury and ViaBTC.Speaking of , it is possible they have received some new mining hardware.Support for Bitcoin unlimited seems to be growing as of late.Since ViaBTC is the largest pool supporting BU, it would make sense to see them increase their hashpower.

Right now, ViaBTC sits at 10.7% of the network hashpower, compared to 8.9% four days ago.It is not impossible one or two miners have switched allegiances when it comes to mining pools.

bitcoin escrow accountAntpool has gained some hashpower as well, going up from 15% to 19.3% over the past few days.

bitcoin book andreasF2pool is dipping slightly, although that is not uncommon either.

ethereum support levelsThe biggest losses come for BTCC, as their hashpower has nearly been cut in half.

bitcoin paul campRight now, BTCC mining only has 4% of the network hashrate, compared to 7.6% a few days ago.

bitcoin pool share chart

With the bitcoin mining difficulty increasing, mining becomes even less profitable for smaller operations.Depending on how much one pays for electricity, the costs can quickly outpace the rewards.

bitcoin pool spainFor manufacturers of hardware, that is not such a big issue.

bitcoin foundation clubSmaller miners, on the other hand, may start switching off their machines in the coming weeks if this trend keeps up.

bitcoin banned in new yorkIt appears this mining difficulty increase is a result of the .

dogecoin value usdBy purchasing hardware that can only mine SHA-256 and do nothing else, the network is receiving an influx of new hashpower at an accelerated pace.This practice has gotten quite a lot of negative attention among bitcoin miners, though.

This plan is created by Jiang Zhuo’er, who seems intent on destroying the bitcoin network over time.About two weeks ago, the went up by 16.64% as well.Setting new all-time highs every two weeks is quite exciting for the bitcoin ecosystem.However, it remains to be seen if a new record can be set in two weeks from now.If more hardware comes online to mine, that seems to be a foregone conclusion, though.Update 3:56am UTC, 8th June: Attribution & link added for Chandler Guo 'Blockchain will shut down' quote source.At the heart of Bitcoin is a process known as mining, adding transaction records to Bitcoin's public ledger.The ledger is made up of blocks of transactions linked in a chain, forming the widely touted technological breakthrough, the Blockchain.Individual blocks must contain a proof of work to be considered valid, Bitcoin uses the hashcash proof-of-work function.This process is intentionally designed to be resource-intensive and difficult, and the protocol provides a block reward to incentivize miners.

The reward is also a way to initially distribute coins into circulation, since there is no central authority to issue them.The block reward currently supplements transaction fees, paid at the user's discretion.As more users send bitcoin transactions, and blocks become full, those transactions with the highest fees will be included first.This guarantees a swift transaction for users willing to pay more, and is designed to eventually fund the entire process of mining.However, transaction fees are currently average less than half a bitcoin per block.While the reward currently supplements the fees, the amount of bitcoins rewarded is designed to reduce over time, halving every 210,000 blocks.With fewer than 5000 blocks remaining till the next halving event, predicted to occur on July 10th this year, the reward is poised to decrease from 25 bitcoins per block, to 12.5.While the event, and the mechanics that drive it, are well documented and understood, the potential ramifications are hotly debated.

What the greater bitcoin mining community will do in response is currently impossible to know.Simple arithmetic would seem to indicate that miners with less-efficient mining equipment may be inclined to shut down their operations.Large mining operations often have several locations, with hundreds or thousands of mining 'rigs' at each.Aside from the initial setup costs, the main ongoing expense is electricity.Chandler Guo, founder of Chinese multi-service bitcoin banking platform Bitbank fears that the reduced reward may lead to fewer miners.“When halving comes the cost of the electricity is the same, so it must shut down,” Guo explained.“If mining equipment can only mine the electricity payment, they don’t need to work.” The problem that Guo points out is Bitcoin's difficulty rate.To compensate for increasing hardware speed and varying interest in running mining operations, the proof-of-work difficulty number is determined by a moving average, targeting an average of six blocks per hour.

If blocks are generated too fast, the difficulty increases, and vice versa.This re-balancing occurs every 2016 blocks, roughly every two weeks, and has the effect of ensuring that miners produce the right number of blocks.According to Guo, it might also have more scary effects under a halving condition.During an interview with CoinDesk, Guo made the bold claim that the blockchain could shut down; - Chandler Guo, Bitbank Founder, speaking to coindesk.While Guo highlights a worst case scenario for the fledgling alternative financial system, he also highlights the systems saving grace; the value of bitcoins on the open market.Miners pay their bills in fiat currency.Immediately after the 2012 halving, there was a month or so of downward price movement, and then 2013 then became one of the most bullish and exciting years in Bitcoin's history.So the question becomes whether or not the 2012 block reward halving was one of the causes of that bullishness.Many feel that it was not; the market price reflects the event well in advance.

The price of bitcoin rose gradually over the six-month period leading up to the 2012 halving, more than doubling in price between June and November 2012 This effect could easily be explained by traders preemptively pricing in increased scarcity.Bitcoin developer David Perry pondered this issue in his last-minute blog post preceding the 2012 event.A poll of the community showed that far more people believed the value of bitcoin would rise more after the halving, but they didn't seem to consider it priced-in before the event.The debate and theoretical discussion continue to this day.Other than the previous bitcoin reward reduction, the closest thing we have to another halving happened on the Litecoin blockchain, last August. website states that, “a wild speculative rally took the price from 2$ to more than 8$, before crashing back to 3$,” two months prior to the event.It is now starting to look like Bitcoin's price may be headed in the right direction to match the doubling in time as well.