bitcoin cyprus crisis

They won't make a sound no matter how many of them you try to toss in a bucket, and you can't pitch them in a fountain and wish for good luck.But make no mistake, bitcoins are getting big.The online alternative currency, previously little more than a curiosity in financial markets since its 2009 inception, has zoomed in trading value since the Cyprus banking crisis erupted two weeks ago.With fears spreading that even insured deposits might not be safe in similar nations hit by banking crises, those looking for a haven to store their wealth have fled to the complicated world of digital cash."Incremental demand for bitcoin is coming from the geographic areas most affected by the Cypriot financial crisis—individuals in countries like Greece or Spain, worried that they will be next to feel the threat of deposit taxes," Nicholas Colas, chief market strategist at ConvergEx, said in a report on the startling trend.(Read More: It's Back!Dark Cloud From Europe Stalls US Stock Market Bull Run) Bitcoins operate on a network that, at least on the surface, resembles a typical exchange on the capital markets.

Buyers can exchange their paper currencies for bitcoins and use them wherever they are accepted.Sellers can exchange their bitcoins back for their original currency.But the value of the currency has been anything but typical. lists the value of bitcoins compared to other currencies, including U.S.and Canadian dollars, euros and pounds.On one of the U.S.currency exchanges, labeled "Mt.Gox," the bitcoin value has zoomed to more than $87 in Wednesday trade.That represents close to a 20 percent gain over just the past week, a one-month gain of 41 percent and nearly a quintupling of value in the past year.Gox" euro trading has seen numbers nearly identical to the dollar pairing.(Read More: Cyprus Controls to Hit Foreign Transactions) A more sober perspective might suggest that bitcoins are at best a momentary bubble and at worst a risky chance to take considering their novelty.But the trend also exemplifies just how nervous cash-holders are over the European situation."This is a clear sign that people are looking for alternative ways to get their money out of the country," said Christopher Vecchio, currency analyst at DailyFX.

"If we're going to talk about the stability of the euro and whether or not there are going to be capital controls in place not just in Cyprus but around the euro zone, I think there is some efficacy behind bitcoins as an alternative liquidity vehicle."The role of alternative currency had been falling largely to gold over the past several years.But the precious metal has been on a pretty aggressive downward path since its most recent peak in October.(Read More: CNBC Explains the Wild World of Currency Trading) Gold advocates, though, continue to stress its importance as a safe haven and store of wealth.

move litecoin"Why would anyone trust an electronic form of money that could get hacked and then diluted into oblivion?"

ethereum unlocksaid Michael Pento, president of Pento Portfolio Strategies.

move litecoin

"We already have a form of money that is indestructible and whose supply cannot be increased by any government or individual decree.Yet currency pros are at least willing to give bitcoins the benefit of the doubt as a legitimate trading vehicle as situations like Cyprus continue to crop up.The $964 million bitcoin network pales to the $4 trillion a day in total currency trading, but it's clearly growing."Right now it seems safe.Personally it wouldn't be my preferred vehicle to trade money because it's unregulated," Vecchio said.

bitcoin calculator hash"But people are deeming it legitimate even though it's not backed by a sovereign.

bitcoin crush androidThat could be the attraction behind it.

crypto bitcoin faucetThere's no sovereign credit risks to bitcoins."Follow him on Twitter @JeffCoxCNBCcom.

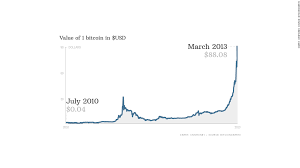

Bitcoin is an unusual place to seek security.It's a four-year-old digital currency developed by a hacker who still remains anonymous.But these are unusual times.Depositors in the tiny island nation of Cyprus are struggling to gain access to cash stored in the nation's banks, and some face losses on their deposits.The situation has caused investors all over Europe to question the safety of the banking system.The price of one bitcoin has popped 87% since Cyprus began discussing tapping deposits as part of the bailout by the EU and IMF.Bitcoins now trade at $88 each, up from $47 on March 16, 2013, according to data from Mt.Gox, the currency's main trading exchange.That compares with just 5 cents per bitcoin in mid-July 2010, when Mt.Gox first started tracking prices.Trading volume has also exploded.Between 60,000 and 110,000 bitcoins have changed hands per day recently, according to Mt.That's double to triple the amount traded a few weeks ago.Albert Hendriks, a 32-year-old programmer for a high-speed trading firm in Amsterdam, jumped into the currency for the first time this week, purchasing €1000 worth of bitcoins.

He's not worried about the safety of the global banking system, but he sees bitcoins as a lucrative investment."I think the currency is maturing," Hendriks said."It's risky, but I think more and more people are starting to trust it."Bitcoin investors can trade in their coins for cash through a number of sites like Coinbase and BitInstant that work directly with banks to facilitate transfers.Some vendors are starting to accept the coins too, including the blog hosting site Wordpress and the online community Reddit.Jeff Berwick, a media entrepreneur who runs the website Dollar Vigilante, hopes to open one of the world's first bitcoin ATMs in Cyprus in the next few weeks.The ATM there would allow individuals to retrieve cash for their digital bitcoins or put cash into the machine to add to their bitcoin collection."It's going to be an experiment," said Berwick, who also aims to install a machine in Los Angeles in the next few weeks.Bitcoin has been one giant global experiment since an anonymous developer using the pseudonym "Satoshi Nakamoto" created it in 2009 as a currency that's free from government intervention and has no central bank backing.

Bitcoin transactions typically carry very low exchange or processing fees.As of now, nearly 11 million bitcoins are in circulation, making the current value of all outstanding bitcoins roughly $975 million.These coins are "minted" by a network of computers running specialized software on powerful (and often pricey) hardware systems.The software is designed to release new coins at a steady -- and finite -- pace that slows down over time.Bitcoin's algorithm caps the total number of bitcoins that will ever be created at 21 million.More than 99% of them will be circulating by 2033, but the very last bitcoin won't be generated until around 2140."The point of the bitcoin is that you don't have to trust the founder," said Jeff Garzik, a computer programmer in Raleigh, N.C., who has served as a consultant to businesses working with bitcoins."People are drawn to it because it can't be artificially manipulated by any human.Central bankers can't just decide to make more of it."Last week, the Treasury Department's Financial Crimes Enforcement Network issued new guidelines outlining what anti-money laundering rules virtual currencies like bitcoin must follow.