bitcoin bubble november

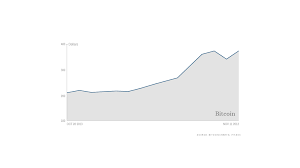

Investors are piling into the digital currency, which is not issued by a central bank but is conjured into being by cryptographic software running on a network of volunteers’ computers.This week the price of a Bitcoin soared to above $1,000, from less than $15 in January.Having long been favoured by libertarians, gold bugs and drug dealers, Bitcoin is attracting some surprising new fans.Germany has recognised it as a “unit of account”.Ben Bernanke, chairman of the Federal Reserve, told a Senate committee on virtual currencies that the idea “may hold long-term promise”.A small but growing band of shops and firms accept payments in Bitcoin.Some like the way it allows funds to be transferred directly between users, without middlemen.Others are attracted by the potential for anonymous transfers, or by the fact that the number of Bitcoins in circulation has a fixed upper limit—so there is no way a central bank can inflate their value away by issuing more.Should the Lions pick all 15 players from one team?A new front in the legal fight over Donald Trump’s travel banQatar Airways wants a 10% stake in American AirlinesIreland and Afghanistan become the first new Test nations in 17 yearsWhy calculating a British parliamentary majority is so trickyHumanist nuptials are popular in Scotland but only beginning in UlsterBut the recent price surge, driven by Chinese investors stashing money offshore, looks like a classic bubble.

Hoarding means that Bitcoin is currently more of a speculative asset than a currency.And a crash is not the only risk Bitcoin users face.As the price rises, Bitcoin theft is increasing, both from individuals and from online exchanges that store the coins and convert them into other currencies.Around $1m in Bitcoins was recently stolen from BIPS, a European exchange.GBL, a Chinese Bitcoin exchange, abruptly vanished in October, taking $4.1m-worth of deposits with it.The system itself is straining at the seams (see Technology Quarterly).The amount of computing power consumed by its transaction-verification system, which has the side-effect of “mining” new Bitcoins, is mushrooming: it now far exceeds that of the world’s 500 fastest supercomputers combined.At the same time Bitcoin’s method of recording and processing transactions, and compensating those who verify them, is becoming unwieldy.Adjusting Bitcoin’s protocols, however, requires getting the volunteers who maintain its software to agree on the necessary changes, and the Bitcoin community to adopt them, before anything goes wrong.Excitement about Bitcoin, and concerns about its limitations, have prompted the emergence of many other cryptocurrencies, or altcoins.

Litecoin, for example, retains Bitcoin’s limited money supply but offers faster transactions and is intended to prevent a computational arms-race among miners.And whereas Bitcoin was created by a mysterious figure known as Satoshi Nakamoto, who vanished in 2010, Litecoin’s creator, Charles Lee, makes no secret of his identity.

litecoin vs bitcoin vs ppcoinPeercoin has no money-supply limit, built-in inflation of 1% and a more energy-efficient mining process, though, as with Bitcoin, its creator is unknown.

bitcoin crime unitAnoncoin and Zerocoin, meanwhile, strive for complete anonymity—which Bitcoin lacks.

bitcoin transaction id formatAnd so on.We’ve heard this song beforeBitcoin, then, is merely the first and, for the time being, the best-known example in a new category.

ethereum usd history

In many ways it is akin to Napster, the pioneering file-sharing service that upended the music industry in 1999 by allowing internet users to call up almost any song at will.Though Napster, unlike Bitcoin, was illegal, it demonstrated that there was enormous demand for what it provided, prompting many other services to spring up in its wake.

bitcoin mining virusJust as Napster paved the way for BitTorrent, iTunes and Spotify, Bitcoin has triggered a surge of innovation in digital money.So let a thousand altcoins bloom.

bitcoin tamil newsIn the meantime, if you are lucky or clever enough to have owned an asset whose price has risen 60-fold in a year, it might be time to sell.Correction: This article originally stated that Litecoin was intended to be more energy-efficient than Bitcoin.

bitcoin wallet on linux

In fact, its design strives to prevent a computational arms-race among miners by reducing the benefits associated with specialised mining hardware; Peercoin is designed to allow more energy-efficient mining.This was corrected on November 29th.Bitcoin’s price has taken off again, forcing some to defend the value of the currency as utterly un-bubblish.

bitcoin exchange drugsThis becomes a humorous exercise.

bitcoin cnn en espanolThe finance nerd community (of which I’m not nearly good enough to be a member) is done talking about the Trillion Dollar Coin for now, so it’s back on the Bitcoin bus.Bitcoin is trading at record price points, currently clocking in at around $264 USD per coin.To put that price point in perspective, in April Bitcoin spiked to around $237.It then fell all the way to around $69 in July.And now we are back north of the $200 mark, rapidly approaching the $300 ceiling.

People keep saying this isn’t a bubble, and it confuses me.Of course this is a bubble.It’s a far too rapid increase in the price of a financial instrument that is unmoored from any inherent value that is being bid up by aggressive individual speculation.What else is that?Joe Weisenthal, better known as @TheStalwart, called Bitcoin a joke today, making the following key point: “The currency has been surging several percent every day lately, and that’s evidence that it’s not in a bubble?” Bingo.But there is another point that is worth keeping in mind.It appears that Bitcoin is currently seeing its value break ranks with its transaction volume.This is not what we have seen in the past, when the two were in loose unison.Here are two charts, the first showing the price of a single Bitcoin in USD, and the second showing Bitcoin transactions per day.Follow both from left to right, and see if you can feel the change: What’s going on?We can’t be sure, but I think that the shuttering of Silk Road has led to a meaningful decline in Bitcoin transactions.