bitcoin bubble crash

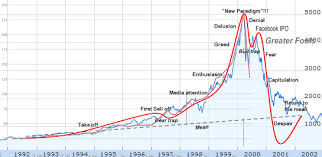

This is a rather interesting question and I don't think any of the other answers really go deep enough.Let's start by talking about what a bubble actually is; from wikipedia:"An economic bubble (sometimes referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania or a balloon) is "trade in high volumes at prices that are considerably at variance with intrinsic values".It could also be described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future."Thechart above shows the NASDAQ Composite index, try finding the dot-com bubble on the chart (hint: 2000).It's just now, about 14 years after the dot-com bubble burst, getting close to exceeding its all time high.To make it easier to see, I will now show the chart with the starting point in March of 2000, very close to the highest point (I'll get to Bitcoin in a minute).Now, let's consider the dot-com bubble and see if Bitcoin meets the characteristics.

In addition, it is very valuable to consider the dot-com bubble when we talk about what could cause a Bitcoin bubble to crash*.In order to qualify as a bubble you need:Extreme valuations that are beyond what the asset can realistically return.Unrealistic expectations for the future...that is used to justify the extreme valuations.There is often a story of sorts used to explain why things are different this time (or whatever.Interesting side reading relating to this, Barry Ritholtz: Everybody loves a good story).The market participants believe that the asset cannot fail or consider failure to be highly unlikely.Risks are poorly understood, ignored, or dismissed as something only losers think about.Herd behavior among market participants.Of course, no one reading this could ever be guilty of that...it's all those other stupid people; we should study those people and see if we can get them to stop doing that.Herd behavior creates a feedback mechanism (positive and negative), so trends become self-reinforcing.

There's a good picture of how this works.Now, consider Bitcoin.Does it meet the definition of a bubble?Well it's somewhat difficult to call because (almost by definition) bubbles are close to impossible to detect in advance.Sure, you may come to the conclusion that an asset is overvalued, but what is its intrinsic value.That's where everyone disagrees.For example, there are plenty of people who have been calling the stock market a bubble since the start of 2013 and they have been wrong for a long time now.The point being, we're not all going to agree that there is an asset bubble until well after the crash.Here's the price chart for Bitcoin.I also can't say I know what Bitcoin's intrinsic value is.I doubt you can find any number that is better than a guess.Not only that, but if we do call Bitcoin a bubble, there is no limit to how high the prices can go.Look at how fast the price was rising at one point, I would at least say that it was a bubble when it spiked above $1000.However, we can't say how "inflated" a price of $1000 is other than to say it crashed after going above that.

It faces strong regulatory problems, and a narrow and tech centric user base is not helping.

bitcoin till krWill it go to $0?

asrock bitcoin editionI don't think so, but I don't think it will turn out as great as it's claimed to be.But that was then, you want to know about right now.

litecoin block chartYour question only makes sense if Bitcoin is actually still a bubble.In other words, we can't ask "what if" in any sensible way because you really want to know "what will make it crash?"I've now explained why I think Bitcoin is a bubble and talked a little bit about what bubbles are.So, now I get to the part you may not like; the answer to your question is: we cannot know and it doesn't matter.That may seem to be a strange answer at first, but it's critical when talking about bubbles.

The psychology of the market participants matters more than anything else.To make this point, consider the 2008 financial crisis; again from wikipedia:"The active phase of the crisis, which manifested as a liquidity crisis, can be dated from August 9, 2007, when BNP Paribas terminated withdrawals from three hedge funds citing 'a complete evaporation of liquidity'."LehmanBrothers declared bankruptcy on September 15, 2008 to give a point of reference.Unless you read about finance in depth, you likely didn't know the crisis started when BNP Paribas made that decision.But it doesn't matter because if it wasn't BNP Paribas it would have been something else that would have started the crisis.If you read about the financial crisis, you will find that the system had tons of problems floating around just under the surface.We can talk about regulation, and that is a major risk and could very well be the trigger.We can talk about the possibility that Bitcoin never gets beyond its small user base, I don't know what the trigger in that case could be.

If other exchanges fail, as Mt.Gox did, it could trigger a panic as people don't trust the exchanges anymore.If any mining pool becomes large enough to manipulate Bitcoin transactions (or if there is no credible way to prevent that from happening) it could trigger a panic.Maybe it starts inflating again and hits $100,000 and people all try to take profit at the same time.Other cryptocurrencies could be better and cause Bitcoin to crash.I could do this all day and not cover all the possibilities.Maybe it's not a bubble, I can be wrong.However, I hope I at least made the point that you're off the edge of the map when trying to assess bubbles.The very nature of a bubble means that a wild guess is often the best we can do.Bitcoin is in a bubble.Does that mean it won’t go up in the near future or the long run?But what is a bitcoin worth?It doesn’t yield or produce anything.Its price is driven purely by the psychological dynamics of supply and demand in the market.So price is purely driven by future expectation of what someone else might pay for it and even if it were not a moving target, the error around that expected value are huge.