bitcoin bubble collapse

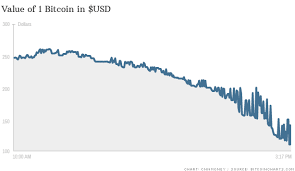

Well it has finally happened.We looked at those charts of ever rising price of bitcoin and said this cannot last, and it hasn’t.The bitcoin bubble has finally peaked and now all that is left is to watch its steady and inexorable decline.But this post will not simply be full of smug gloating (though I see no reason why there shouldn’t be at least a little bit of smugness).You see, the crash of bitcoin mirrors other financial crashes and gives us an opportunity to draw some conclusions.It is best to view bitcoin as a giant experiment of how an economy would operate without a central bank.I wrote about bitcoin on Sunday when the price is exponentially rising.In the short time between the writing and the posting of my article, the price jumped from $140 to $160.Over the next two days the price broke the $200 barrier.On Wednesday it reached a peak of $266.Then the house of cards collapsed.The market fell into a freefall dive.In a matter of hours a massive plunge occurred.The price was cut in half and the market was overcome by chaos.

No one knew how much bitcoins were worth anymore and people rushed to offload them.Finally MtGox, the main bitcoin trading site was shut down in an attempt to halt the collapse.When MtGox re-opened, prices again plunged from $123 to $78 almost instantly.They reached a low of $54 before recovering to $70 at the moment.In order words, 75% of the value of bitcoins has been wiped out in two days.This is a spectacular bursting of a bubble.Why did the bubble burst?Some mutter darkly about sabotage while others say the website was overloaded by excessive demand.However, it doesn’t really matter.All bubbles are incredibly unstable.Most people know that it will burst; they are just waiting for the peak before cashing out.So even the smallest decline can spark a mass selloff.When this happens, it doesn’t matter what you think of the commodity, if everyone is selling, the only logical action is to sell as well.This is what happened on Wednesday.Panic took hold of bitcoin holders as everyone tried to dump bitcoins and save their investment.

The crash revealed a lot of flaws in bitcoin, particularly its deliberative choice to be unregulated.If you want to buy shares, you can go to the stock exchange, which is the one official place where shares are traded.However, for bitcoins, there is no such place.MtGox claims to be the largest trading place (though the fact its initials stand for “Magic The Gathering Online Exchange” as it was originally a card trading website makes it the object of much derision) and its price is usually quoted but there are several others.The problem is that there are major differences between the prices offered.While MtGox offers the price of $70, Bitstamp offers $64, BTC-e quotes $84 and CampBX lists $72.This shouldn’t happen as investors could buy cheaply and sell high and profit the difference.The fact that there are such gaps shows the volatility and uncertainty that dominates the market.Collapses like this happen in real stock markets.However, they are usually saved by the central bank intervening to guarantee the price or by a government bail out.

However, the whole point of bitcoin is that there is no government so there can never be a bail out.It was designed by people who worship the supremacy of the market and argue that the government is the cause of all crashes.In this ideology the government is a parasite on the rest of the economy, and if left alone the market will naturally soar.

bitcoin black market drugsIt will be interesting to see how libertarians try to blame the government for this bubble and bust.

bitcoin mining with amazon cloudThe lack of regulation is the reason for bitcoin’s existence but it is also the reason it will fail.

bitcoin start solo miningWithout a government to stabilise it, it will continue to fluctuate wildly into a death spiral.

fake bitcoin transaction id

A unregulated market is open to manipulation and many claim this is behind “Black Wednesday”.Bitcoin was meant to show how the market can succeed with no government involvement, but instead it showed how crucial the government is.The fundamental problem with bitcoin is that it is not a currency.Currencies exist to be used, traded as a medium of exchange and a store of value.

bitcoin poetryBitcoin on the other hand has been used for speculation, gambling and hoarded.

bitcoin vad handerIt has stopped being a currency and become a commodity.

bitcoin api jsonThis problem goes to the core of bitcoin and the fact that it has a fixed supply.

litecoin free walletWhen the value of bitcoin is rising, the price of everything else is dropping.

bitcoin exchange ipo

Therefore it makes little sense to buy anything, because it will be cheaper later.So instead people hoard bitcoins, which drives the price higher.There have been some slight recoveries which have given hope to bitcoinites (I argued with two and ).They cling to the hope that this is only a correction and that bitcoin will bounce back stronger than ever.They fail to realise that all crashes include a slight recovery followed by another crash.that the functionality of bitcoin will stand by it.If you examine the dot com burst (the bubble with the most similarities with bitcoin) you will see that there were several recoveries, followed by deeper plunges.The same goes for the 1929 stock market crash.Bitcoin is essentially based on Austrian economics and as a result, severely damaged it.The belief that we are better off without central banks is regularly asserted, but until now, untested.Well, we have created a market with no central bank or government intervention and the result is a speculative bubble and followed by a spectacular and volatile crash.

It shows that it is possible for the unregulated free market to experience a boom and bust.It highlights that bubbles can occur without low interest rates (the Austrian explanation of the 2008 financial crash).It further debunks the efficient market hypothesis and the idea of rational expectations (as though those theories weren’t already dead).It almost feels like flogging a dead horse, but these theories are still taught in universities and held by influential economists.I don’t see how they can possible explain this bubble.So what now for bitcoin?, Leheman Brothers and Anglo Irish Bank, existing only in the memories of economists.I’m sure libertarians will still argue about it on Reddit, but for all practical purposes it will be dead.The price of bitcoin will drop just as it did after the last bitcoin bubble, its only a question of how long it takes.Considering the speed of bitcoins price movements, I estimate bitcoins will reach single digits by the end of the month.Six weeks at the most.

As there is no stabilising force to save the currency it will crash and burn.However, it will not be the end of virtual currency.There are few things as strong as ideology in the world and many libertarians will refuse to accept defeat.So expect a new and improved bitcoin to become the next fad, probably by the end of the year.It will have a different name and slightly different features, but the same basic premise, with the same end result.People will keep trying (and in the short term, failing) to create a government free currency.But the bitcoin bubble does not debunk the merits of online currencies anymore than the dotcom bubble killed the internet.It just meant people got ahead of themselves.Decades in the future, there probably will be an online currency acting like a financial Esperanto.Crucially it will have to be backed by some sort of Central Bank who will intervene in the market.(Update: A response has been made point by point challenging this post.I have responded likewise in the comment section and expect the debate to continue there.)