bitcoin after silkroad

Bitcoin, world's most popular digital currency, had a roller coaster ride today after the federal government shut down the Silk Road, an online marketplace where millions of bitcoins were swapped for drugs and black market products over the past two years.As news of the Silk Road shutdown spread, bitcoin values took a tumble, initially dropping by about 20 percent, or close to $500 million by mid-morning, Pacific time.But values soon crawled back.On the Bitstamp exchange, for example, bitcoins dropped from about $125 to $90, before climbing back to $115 at midday.On the slightly inflated Mt.Gox exchange, values went from $140 to 109, before jumping back to $128.In addition to taking down the Silk Road, The Federal Bureau of Investigation arrested Ross William Ulbricht, 29, the San Francisco man who allegedly ran the site under the alias "Dread Pirate Roberts."He's facing drug trafficking, money laundering, and hacking charges.In in an affidavit filed in the case, the FBI specifically addressed Bitcoin, saying that although the digital currency isn't just for the black market, it can be used for nefarious purposes."Bitcoins

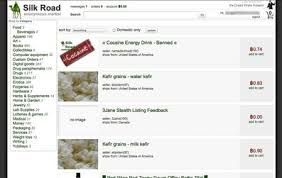

are not illegal in and of themselves and have known legitimate uses," wrote FBI Special Agent Christopher Tarbell."However, bitcoins are also known to be used with cybercriminals for money-laundering purposes, given the ease with which they can be used to move money anonymously."Thereare about 11.7 million bitcoins in circulation, with another 25 created every 10 minutes.Today, you can buy groceries using bitcoins.Or a pint of beer.But after it was launched two-and-a-half years ago, the Silk Road quickly became one of the fledgling digital currency's most popular marketplaces.According to the court documents released in connection with the takedown, the Silk Road handled BTC 9.5 million in transactions over its two-year life.The feds peg that at $1.2 billion, but that estimate prices bitcoins at $126 each, which was the value as of yesterday.For most of the life of Silk Road, they traded for much less than that.With the marketplace shut down, some drug sellers may be moving to liquidate their bitcoins, says Dan Held, the founder of Zero Block, a bitcoin market information service.

But most of the market movement today is probably "a psychological thing," as a large bitcoin marketplace has shuttered.Earlier this year, federal agents shut down another digital currency system, Liberty Reserve, claiming that it was a hub for cyber-crime.But, according to the Silk Road documents, the Federal Bureau of Investigation seems to be taking a different approach to bitcoin.The Silk Road shutdown won't have any significant effect on bitcoin's long-term value, says Patrick Muck, the lawyer for the nonprofit Bitcoin Foundation – a group chartered with the currency's advocacy and software development.

bitcoin miner 1 th/s"Over time the value of bitcoin will be determined by its useful purposes," he says.

ethereum insurance"Day to day price fluctuations based on events in the news are not really an effective or accurate measure of the value of the system."

bitcoin calculator gbp

The price of Bitcoin, the anonymous peer-to-peer digital currency, plummeted after the alleged founder of the online drugs marketplace Silk Road was arrested in San Francisco.On Wednesday afternoon the price of one Bitcoin (BTC) was $145.70 on Mt Gox, one of the largest exchanges for the currency.

ethereum about to explodeAfter the news that Ross Ulbricht had been arrested and the Silk Road site seized, the exchange rate plummeted to a low of $109.76, before recovering to $124.00 late on Thursday.

litecoin analysisIn the history of the notoriously volatile currency, Wednesday’s fluctuations are minor.

bitcoin mining hosting ukBitcoin has experienced two major booms and busts, one in 2011 when the value of one Bitcoin went from $2 to $30 and back in little more than six months, and another earlier this year, when the price shot from $13 to a high of $266, before dropping back to a low of $50.

list bitcoin mining pools

Even on a slow trading period, Bitcoin remains extremely volatile.It is not uncommon to see the currency gain or lose 6% or 7% of its value over the course of a day with no obvious news event driving the change.The average daily change of the S&P 500 is a tenth of that.Bitcoin and Silk Road are closely linked.

bitcoin etf australiaThe site, which enables users to anonymously order drugs, guns, and more through the postal service, only takes payments in the digital currency.

bitcoin faucet freeIn doing so, it makes it significantly harder for authorities to follow the money to discover the real identities of buyers and sellers.The technology behind Bitcoin is similar to public-key encryption, the algorithm behind most internet security.Users have a 'wallet', which is a public address that can send and receive Bitcoins, and a private key with which they can access the wallet.

So long as the link between a particular wallet and a user is not made public, the currency can remain fully anonymous.But if a Bitcoin wallet becomes associated with a particular person, some of the security benefits disappear.Because transactions between wallets are public, it can then become possible to trace transactions.“Obviously the major price drop we saw yesterday was people scrabbling for the exit,” says Jeremy Cook, chief economist at currency brokers World First, who describes Bitcoin as “intrinsically linked” to Silk Road.“You've bought Bitcoin as an investment, or you've bought it as a transactional medium.If it’s one, you’ve just seen a major marketplace shut down, and if it’s the other, the value has dropped suddenly.You will sell it.” Emily Spaven, editor of the digital currency news website CoinDesk, agrees that fear is motivating the drop in price.“The price of Bitcoin has fallen since the closure of Silk Road, not because the website was the lynchpin of the Bitcoin ecosystem, but because some people are fearful that this is the beginning of the end.” Silk Road remained one of the most prominent large-scale operations that used Bitcoin, and the largest to exclusively require the use of the currency.

While a number of establishments announced they would be accepting payments in Bitcoin, including a pub in Hackney, east London, many customers appeared to be making the most of the novelty value only.As a result, the site seemed to provide a significant share of actual use of Bitcoin.Even so, one paper from 2012 (pdf) pegged the site as making up just 4.5% of the entire Bitcoin economy.Information from the FBI’s criminal complaint suggests that the average daily volume of Silk Road trades is 10,000 BTC, again around 5% of the 200,000 BTC that the site blockchain.info says is the low end of daily transactions in Bitcoin.“The reality is, Silk Road doesn't play any part in a high proportion of Bitcoin users' lives,” says Spaven.“The Bitcoin economy certainly isn’t reliant on Silk Road; there are hundreds of other websites that accept Bitcoins and I'm confident the list of these will continue to grow.” Indeed, Spaven raises the possibility that the Silk Road bust could be a good thing for the currency.

“If anything, the fall of Silk Road has done Bitcoin a favour.Hopefully now that the website no longer exists, people will start to see Bitcoin in a more positive light and appreciate the numerous benefits it offers.” The Reuters blogger Felix Salmon agrees, suggesting that until now, the fear of such a bust may have exerted a downward pressure on prices.“With Silk Road gone, a significant source of downside tail risk has now been effectively removed from the Bitcoinverse,” he writes.The other question for the currency is what effect the FBI’s seizure of 26,000 Bitcoins, worth around $3.25m at current prices, will have on its economy.If the bureau decides to auction off the seized assets, the glut in supply could temporarily depress prices, and the removal of such a large number from circulation is in effect a monetary tightening.But Cook points out that the quantity is still tiny compared to the total number of Bitcoins available, thought to be almost 12m.“In the grand scheme of things, it's not too much of a liquidity shock.” • How can the FBI seize Bitcoins?