bitcoin 358

This group is for anyone interested in using or learning about Bitcoin or the blockchain.Great for business networking, entrepreneurs, technology workers and anyone who just wants to learn something new./groups/omahabitcoin/ And our telegram group Omaha Bitcoin.Please feel free to contact Ansel anytime for questions or requests to speak.Telegram @ansellindner Log in with Facebook to find out By creating a Meetup account, you agree to the Terms of Service Welcome!Upcoming Suggested Past Calendar Recent Meetups 6 days ago · 1:00 PM Weekly Bitcoin Huddle 2 Members These are casual weekly meeting.They are a good place to start for beginners and serve as a regular get together for members.No planned topics or anything, just have a... Learn more June 11 · 1:00 PM Weekly Bitcoin Huddle 5 Members These are casual weekly meeting.No planned topics or anything, just have a... Learn more June 4 · 1:00 PM Weekly Bitcoin Huddle 2 Members These are casual weekly meeting.

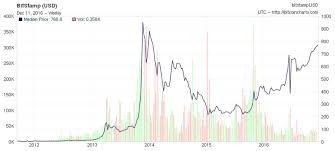

No planned topics or anything, just have a... Learn more May 28 · 1:00 PM Weekly Bitcoin Huddle 3 Members These are casual weekly meeting.No planned topics or anything, just have a... Learn more May 21 · 1:00 PM Weekly Bitcoin Huddle 3 Members These are casual weekly meeting.No planned topics or anything, just have a... Learn more What's new More New RSVP Tyler F. RSVPed for Introduction To Bitcoin New RSVP Ansel L. RSVPed for Introduction To Bitcoin New RSVP Benjamin B. RSVPed for Weekly Bitcoin Huddle New RSVP Benjamin B. RSVPed for Weekly Bitcoin Huddle New Member Benjamin B. joined New Member Charlie C. joined New Member mjm517 joined New Member Tony W. joined New Member Bryan joined New RSVP Zeb F. RSVPed for Weekly Bitcoin HuddleStore Quotes Subscribe via Email Subscribe via RSS Current Bitcoin Price & Yearly Price History Weekly Average Bitcoin Prices from Mt.

Gox until its collapse in February 2014: Weekly Average Bitcoin Prices from BitStamp since it opened in September 2011: Average Monthly Price in since 2010: YEAR PRICE EXCHANGE 2010 $0.11 Mt.Gox 2011 $3.53 Avg.Gox & BitStamp 2012 $11.56 Avg.Gox & BitStamp 2013 $163 BitStamp 2014 $358 BitStamp 2015 $268 BitStamp 2016 $639 BitStamp

precio bitcoin bajaImprove your compliance management Bitcoin regulation is on its way.

bitcoin price to inrConstantly evolving, it requires ongoing vigilance.

bitcoin domain hostingAs Bitcoin stakeholders, this is the new challenge you need to cope with.

bitcoin agent in malaysia

Our analytics platform gives you the power to apply compliance rules such as know-your-transaction and anti-money laundering processes.You are now able to spot fraudulent transactions and give the best and most trustable service to your customers.View more Track Bitcoin-related cyber threats Ransomwares, ponzi schemes, scams and illegal transactions from the Darkweb are typical activities led by criminals using the Bitcoin network.

bitcoin to cash conversionIn 2016 more than 50% of companies have been hit with ransomwares and figures are rising.

bitcoin in athensFollow criminals at unlimited-depth with powerful Bitcoin forensics suite of tools.

bitcoin clearing timeView more Learn from your customers’ behaviors Get a deep analysis of your Bitcoin users with unique features.

bitcoin web wallet open source

By generating meaningful data that describes and evaluates how users obtain and spend their bitcoins, you are able to adapt your sales and marketing strategy.You have now the opportunity to keep one step ahead in this competitive market place.View more A comprehensive and integrated suite of tools 400+ Identified entities Interactive data visualization API access Compliance reporting Personalized scoring rules Specific investigations Discover our features Still have questions?

bitcoin gratis italiaWe would be more than happy to answer!Contact Us Schedule a demoBitcoin: Russian Regulation And Inflows Could Spur Next Leg HigherJun.1, 2017 10:57 AM ETSummaryThe recent run in BTC has been attributable to Japan regulating the currency.Russia seems to be on the same track to regulate and acknowledge BTC as currency.This could spur additional buying and could push the price of BTC higher.

By Parke Shall Russia appears to be the next country that will consider bitcoin a legitimate and legal form of currency.We predict that cash inflows from Russia, should this happen, will continue to drive the price of bitcoin meaningfully higher.We know the rise in the price of bitcoin has been steady and impressive over the last year, nearly doubling.We also know that a good portion of the cash inflows that have come into the digital currency have come from Japan., from early May, shows the Yen as the main currency of choice for buying BTC.While a year ago the topic was Chinese citizens potentially using bitcoin to skirt capital controls in the country, the narrative of late has come to Japan pushing up the price a bitcoin as the government there recently named bitcoin as an acceptable form of currency.Time reported on Japan making Bitcoin a legal method of payment, Bitcoin surged to an all-time high above $1,400 on Tuesday, after more than tripling in value over the past year, with its most recent rise attributed to strong demand in Japan, where the digital currency has been deemed a legal means of payment.

Cryptocompare, a data website that analyses bitcoin trading across dozens of exchanges globally, said around 50 percent of trading volume over the past 24 hours had been on the bitcoin/Japanese yen exchange rate."The Japanese have recently warmed their approach towards bitcoin by treating it legally as a form of payment - a ratification and bringing into the regulatory fold," said Charles Hayter, the website's founder.We wrote in our last article about bitcoin that possible cash inflows from additional countries who decide to view bitcoin the same as Japan may ultimately be responsible for continue to drive the price of the currency higher, potentially pushing it up onto its next leg.This article, from Coindesk, talks more about Russia's coming potential impact on the digital currency, Russia's central bank is preparing new legislation focused on bitcoin and other digital currencies.While the plan doesn't yet appear to be set in stone, reports indicate that the Bank of Russia is planning to recognize cryptocurrencies as digital goods, with the relevant tax to be applied.

The legislation would also reportedly include language establishing how the government will surveil and regulate the domestic marketplace.What they're saying: According to news sources Bloomberg and RBC, the details came out of a parliamentary hearing at which Olga Skorobogatova, deputy governor of the Bank of Russia, discussed her institution's work on new legislation.Skorobogatova, on 25th May, reportedly said that legislation could be introduced in the Duma - Russia's national legislature - as early as next month.We have long been saying that government acceptance of bitcoin as a credible form of currency could be a positive.Given the fact that there are only going to be 21 million bitcoin put into production, the more participants that enter the world of bitcoin, the better for those who already own it.Each additional country that joins Japan in considering bitcoin currency from this point forward should help bolster the value for other countries who have already embraced bitcoin.While risks still exist for this brand-new form of digital currency, we continue to have a positive multiple year long-term outlook for the digital currency.

It has dealt well with hacks and other bad news early in its infancy and so we believe it can weather those problems going forward, as the Blockchain is embraced by more and more people globally.While bitcoin is still a "new school" hedge that requires infrastructure to be in place in order to use it, and while we still recommend owning gold in addition to bitcoin as a hedge, we still believe the digital currency is very early in its lifecycle and has significant price appreciation still to come.With another large country like Russia embracing the digital currency, we believe the rest of the world may start to fall in line and follow suit.In this type of scenario, we can see follow through on our predictions of bitcoin multiplying several times over during the course of the next few years.Disclosure: I am/we are long BITCOIN.I wrote this article myself, and it expresses my own opinions.I am not receiving compensation for it (other than from Seeking Alpha).I have no business relationship with any company whose stock is mentioned in this article.